China’s video game market has taken center stage over the past couple of years with both a strong domestic and export market making headlines. In 2024, Black Myth: Wukong emerged as a hit AAA title, surpassing 25 million units sold globally and showcasing the capabilities of domestic studios in producing globally competitive premium titles. The domestic mobile games sector remained healthy, with new titles including Tencent’s Dungeon & Fighter Mobile, Century Games’ Whiteout Survival, and Papergames’ Love & Deepspace among the standout performers.

Although console gaming remains a niche segment, the Nintendo Switch 2 is off to a strong start in China via grey market imports, building on the success of the original Switch which is the most popular console in the country. Esports is also entering a new phase of expansion, highlighted by the return of Overwatch competitions, the roll out of Delta Force esports initiatives, and the recent debut of Valorant Mobile and its competitive scene.

Government support is another key driver, with over 30 new policies introduced in H1 2025 to accelerate industry development. The National Press and Publication Administration (NPPA) has already approved 946 titles in the first seven months of the year, up 19.3% YoY. Headwinds continue to remain however, including a maturing gamer population, rising operational costs, the threat of regulatory tightening, and escalating US-China trade tensions that include restrictions on GPU exports.

Niko Partners has tracked the China market since it was founded in 2002 and has seen the industry grow from a $100 million market to one that will be worth $50 billion this year.

Fill out this form below to download select key takeaways from the report

The $50 billion opportunity

According to our China Market Model and 5-Year Forecast Report, player spending on video games in China reached $49.2 billion in 2024, up 3.6% YoY.

We expect revenue to reach $50.7 billion in 2025 and grow to $54.8 billion in 2029, at a 5-year CAGR of 2.2%.

There were 722 million gamers in China at the end of 2024, more than 2x the population of the United States. The total number of gamers will reach 753.7 million in 2029, at a 5-year CAGR of 0.9%.

Annual Average Revenue Per User for gamers in China reached $68 in 2024 and is set to reach $73 in 2029.

Our long term outlook remains positive with growth driven by evergreen mobile & PC games, premium PC games, the launch of the Nintendo Switch 2 and next gen consoles, the rise of Mini Games, uptake of niche genres such as dating simulation, increased out of app monetization, engagement with generative AI for user generated content, and direct-to-fan monetization of game IP.

Key insights from our 2025 research

Our China Gamer Behavior & Market Insights Report, which includes a survey of 1,058 gamers, provides key insights on player demographics, behavior and engagement. We produce individual reports for each market on an annual basis that help clients understand developments and opportunities in the region. Clients who want to drill down on their specific target audience are served by NikoIQ, our online knowledge base with model and survey data powered by Microsoft PowerBI. Here’s a look at some of the trends and insights from our latest report:

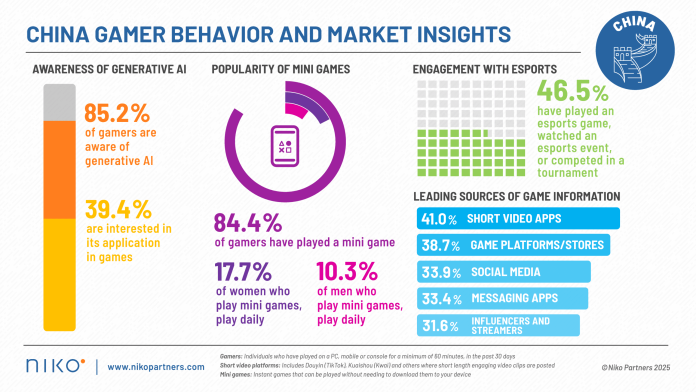

- Chinese gamers have expressed high interest in Generative AI. 85.2% of gamers in China are aware of generative AI technology and 39.4% are interested in its application in games. Chinese game developers are ahead of the game when it comes to Generative AI with 60% of studios already using the technology within their development pipeline. NetEase in particular has integrated multiple Generative AI features into Justice Online Mobile, allowing players to interact with smart NPCs or create custom videos with their in-game character.

- Mini Games have also emerged as a notable segment within China. This refers to games that can be played instantly, without download, and are typically available within platforms and apps such as WeChat and Douyin. 84.4% of gamers in China have played a mini game, with 17.7% of women playing mini games daily compared to 10.3% of men. Mini games are reaching a broader and more casual demographic in China, already accounting for nearly 10% of total player spending on video games.

- Short video applications such as Douyin (TikTok) and Kuaishou continue to grow in importance and are key marketing channels for game developers looking to target players in the country. 41% of gamers in China source new game information from short video platforms, compared to 38.7% that use game platform and store recommendations and 33.9% that use social media. Short video is the leading source for both mobile and PC gamers, while game platform recommendations ranks at #1 for console.

- Esports and game livestreaming remain key verticals in China with 46.5% of gamers having engaged with esports, which we define as either having played an esports game, watched an esports event, or competed in a tournament. 1 in 4 gamers regularly watch video game livestreams with influencers and streamers playing a key role in game marketing and promotion. Niko Partners regularly tracks the game livestreaming ecosystem through our China Games & Streaming Tracker.

Additional data from our gamer behavior survey, including localization best practice and regulatory analysis, is available in the full report.

MOBA & shooter games dominate game livestreaming platforms in China

![]()

Tencent dominated Chinese game livestreaming platforms Huya, Douyu and Bilibili in H1 2025 according to our China Games & Streaming Tracker. Honor of Kings and League of Legends, two MOBA games, had the highest viewership during the period, followed by Delta Force and Valorant, two shooter games. Notably, 11 of the top 20 games are based on global IP or developed by a non-China based developer, showing how international companies have been able to succeed in China.

The tracker also includes unlicensed games, which refers to games that are not officially approved for sale in China but are still accessible to Chinese gamers via platforms like Steam Global. PUBG from Krafton has consistently remained the top unlicensed title in China, followed by Apex Legends (EA). Notable games that launched in the past year and ranked in the top 100 for viewership in H1 2025 include Monster Hunter: Wilds (Capcom), Path of Exile 2 (Grinding Gear Games), and Elden Ring (FromSoftware) thanks to the release of Nightreign.

Niko’s China Games & Streaming Tracker sources data directly from the major game live streaming platforms in China (DouYu, Huya, and Bilibili). We track over 750 games and 140,000 streamer channels across 6 different metrics including the number of streamers, hours streamed, total subscribers, value of tips or donations, Heat Index, and Niko Index. The Niko Index is our algorithmically derived approximation of viewers.

Subscribers to the China Games & Streaming Tracker can view all current and historical data in our dashboard, updated every 24 hours. Niko’s analysts write and post monthly analysis of key trends and data observed in the Tracker to help our clients with important insights. Contact us for more details, to arrange a demo, and book a trial!