- Gaming and Leisure Properties, Inc. recently announced the pricing of a public offering of US$1.30 billion in senior notes to be issued by its operating partnership and a wholly-owned subsidiary, with proceeds intended to redeem existing 2026 notes and support working capital, development, and expansion projects.

- This substantial capital-raising initiative signals an ongoing effort to optimize the company’s debt structure while funding future growth opportunities.

- We’ll examine how this large-scale refinancing and balance sheet management move could influence Gaming and Leisure Properties’ investment outlook going forward.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Gaming and Leisure Properties Investment Narrative Recap

For investors considering Gaming and Leisure Properties, the core thesis centers on the company’s ability to grow and diversify rental revenue streams from its portfolio of gaming real estate while carefully managing tenant risk and capital commitments. The recent US$1.30 billion senior notes offering may ease near-term refinancing pressures and free up resources for development, but it does not meaningfully alter the ongoing exposure to tenant concentration risk, especially regarding Bally’s, whose financial health remains a key short-term concern. The follow-on equity offering completed in May 2025, raising US$554.8 million, stands out among recent company actions for its relevance to the new debt issuance. Both transactions support a more flexible capital structure as the company pursues its pipeline of development projects and expansion initiatives, which hold promise as future growth catalysts if executed successfully. However, against this backdrop, investors should be mindful that significant exposure to any one tenant, particularly one facing credit and cash flow challenges, still…

Read the full narrative on Gaming and Leisure Properties (it’s free!)

Gaming and Leisure Properties is expected to reach $2.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 8.9% and an earnings increase of $382 million from current earnings of $717.9 million.

Uncover how Gaming and Leisure Properties’ forecasts yield a $54.15 fair value, a 16% upside to its current price.

Exploring Other Perspectives

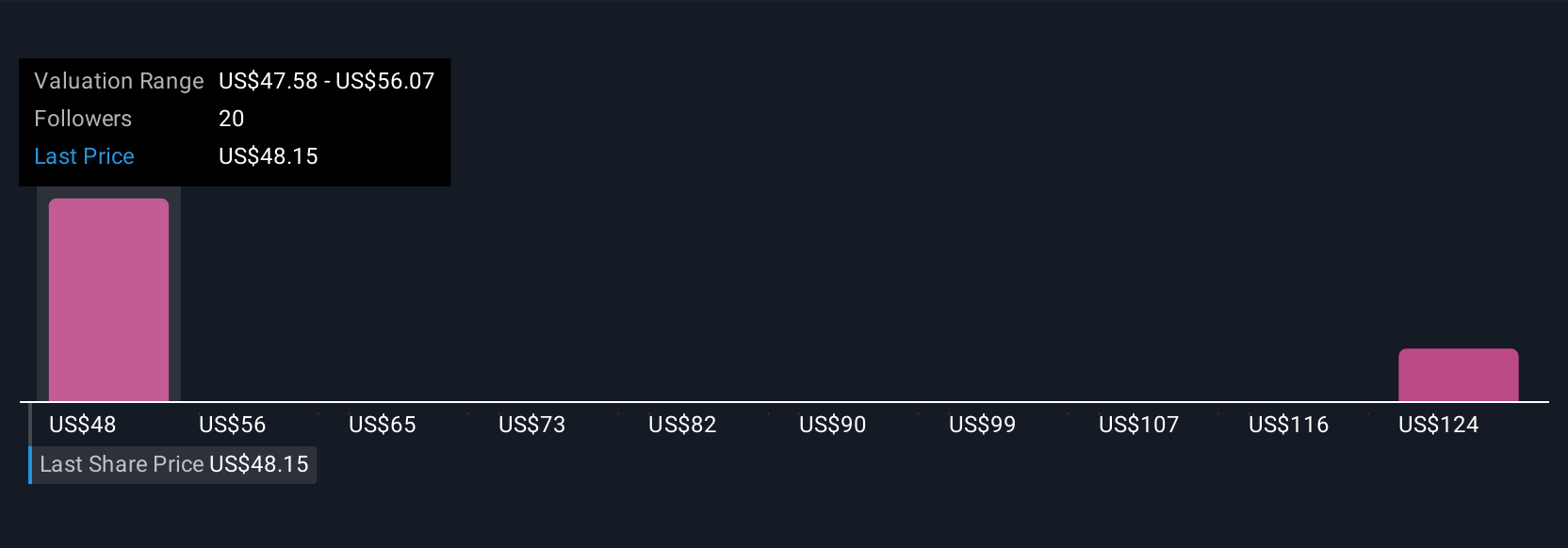

Simply Wall St Community members have posted fair value estimates for GLPI ranging from US$47.58 to US$131.90 across three inputs. While investor outlooks vary, elevated tenant-specific risk remains a top concern for near-term performance and stability, so review multiple viewpoints before forming your own opinion.

Explore 3 other fair value estimates on Gaming and Leisure Properties – why the stock might be worth over 2x more than the current price!

Build Your Own Gaming and Leisure Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaming and Leisure Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gaming and Leisure Properties research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Gaming and Leisure Properties’ overall financial health at a glance.

Interested In Other Possibilities?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We’ve found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com