Reports of the week:

-

InvestGame & GDEV: Investments in Mobile Game Companies since 2020

-

Newzoo: Top 20 PC/Console Games of June 2025 by Revenue and MAU

-

Video Game Insights: Steam Wishlists in 2025

-

Circana: The U.S. Gaming Market in June 2025

-

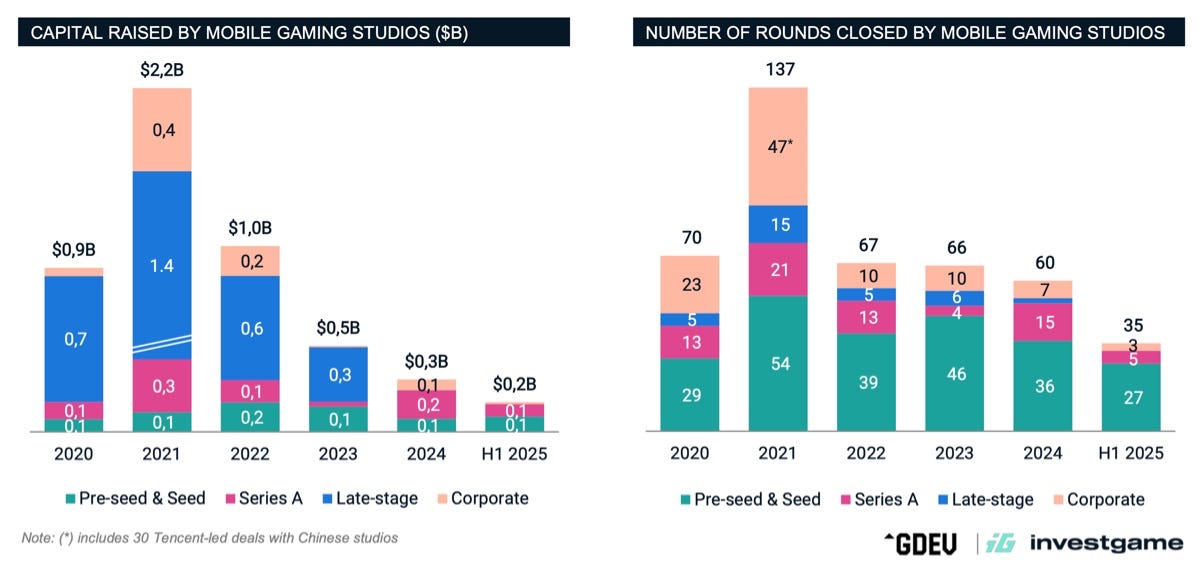

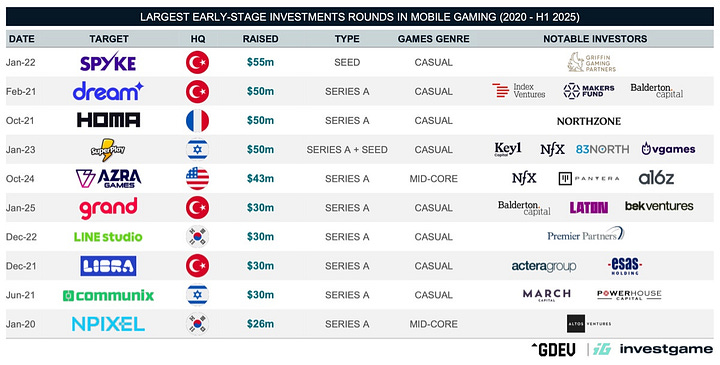

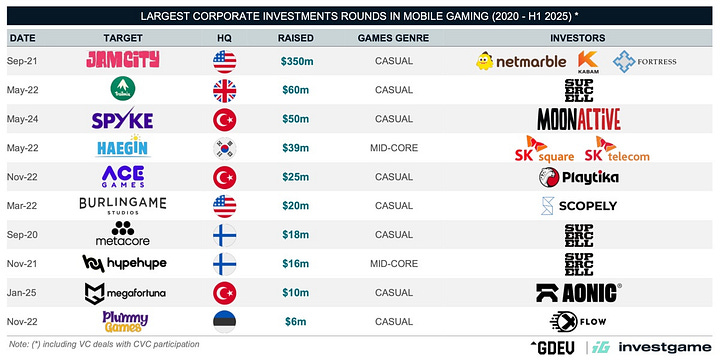

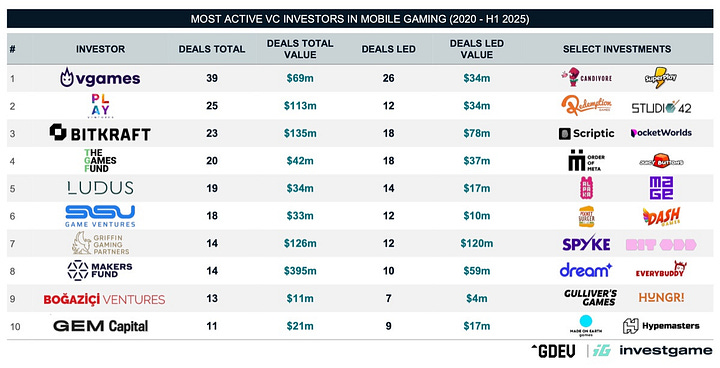

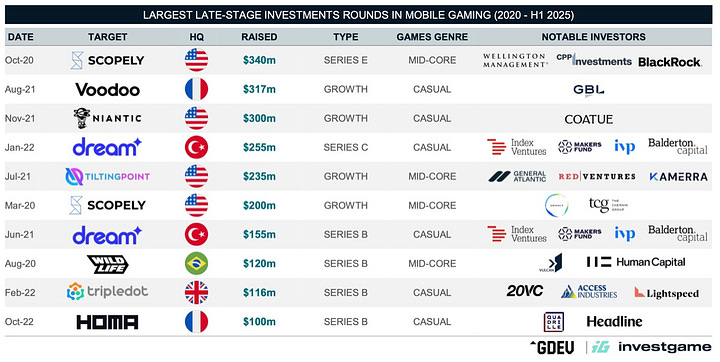

Since 2020, over $5 billion has been invested in mobile studios (435 recorded deals). The majority (302 transactions) were in the early stages, with $1.4 billion invested. 33 transactions totaling $2.9 billion were at late stages (from Series B+). Finally, since 2020, there have been 100 deals involving corporate venture funds or strategic investors, adding another $0.7 billion.

-

The chart shows that during the pandemic market boom, deals doubled, from 70 in 2020 to 137 in 2021. After that, there’s been a decline, which still hasn’t stopped.

-

Casual studios are weathering the crisis better than midcore ones. There are more deals with these studios, and the total amount of those deals is also higher.

-

Turkish companies account for 27% of all VC capital invested in casual mobile studios since 2020. For midcore, however, Europe and Asia lead; 66% of all investments went to companies from those regions.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

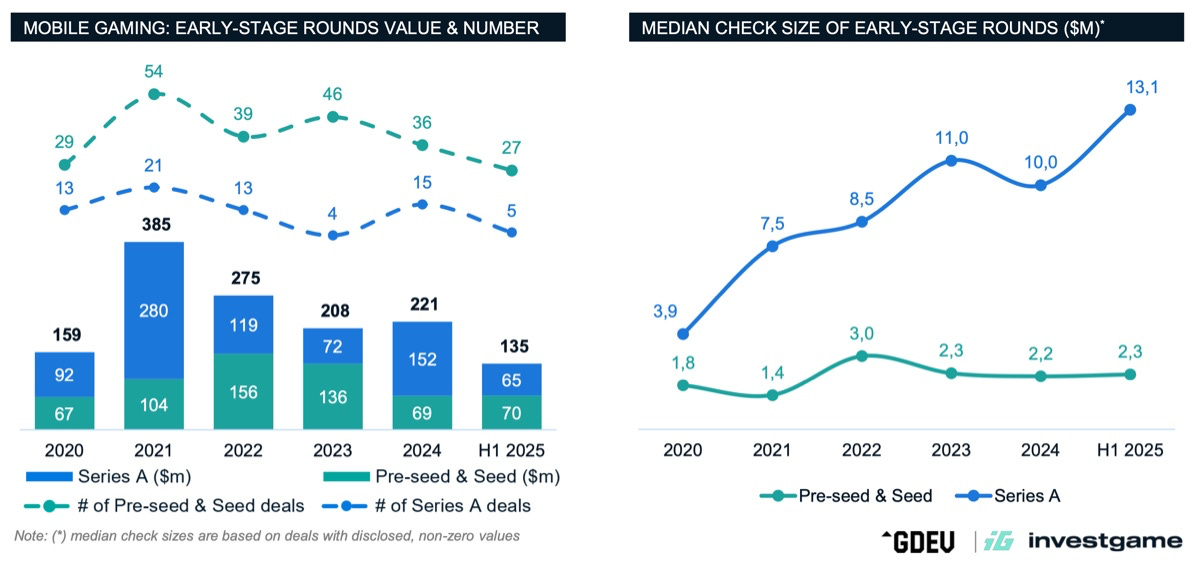

At the same time, structural market changes have hit Series A deals the hardest. Median check has grown significantly, and the number of transactions has dropped sharply. Most likely, this is due to reduced risk appetite; companies at the Series A stage now need to show a proven, data-backed capacity for rapid growth.

-

It is also clear that the median check at pre-seed and Seed rounds has remained unchanged for the last few years. VC investors expect that the team and MVP can be built for $2.3M.

-

Against the backdrop of a more cautious approach from VC investors, the number of M&A deals in the mobile segment has grown over the past 12 months. There have been 5 deals totaling $7 billion—a record figure since 2022.

-

Since 2020, mobile studios have accounted for 61% of the total volume of M&A deals (excluding the Activision Blizzard deal). In H1’25, deals with mobile companies made up 98% of the total volume.

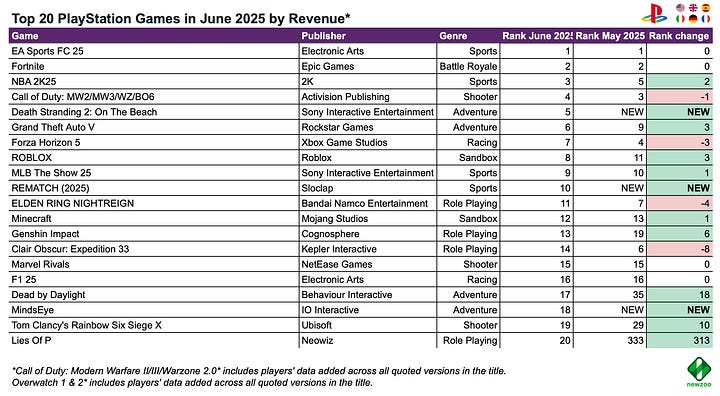

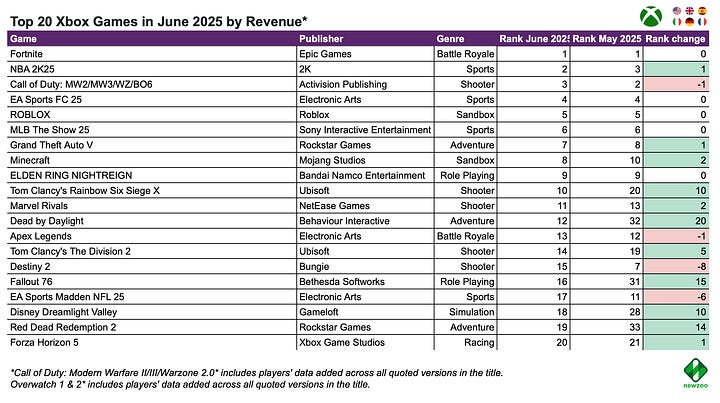

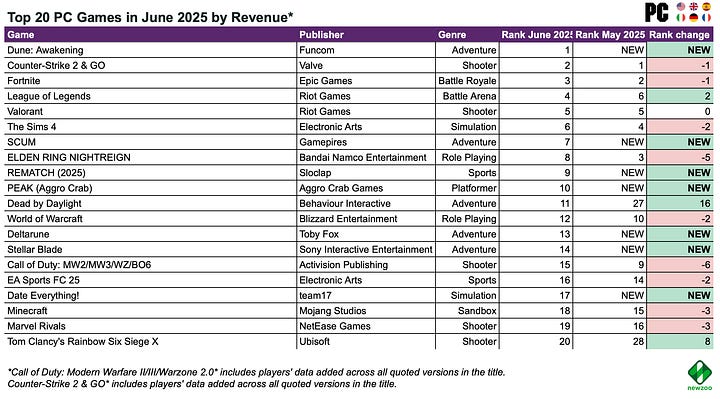

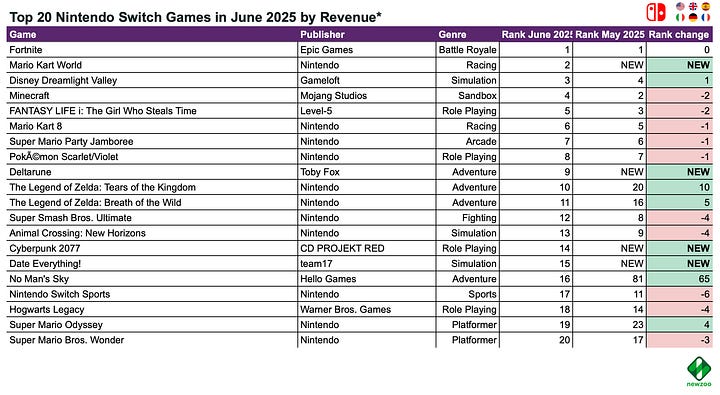

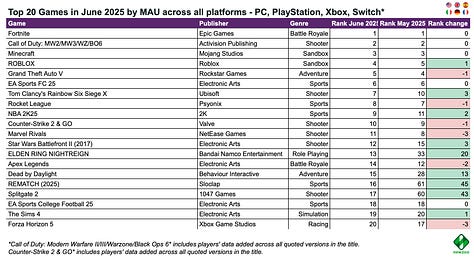

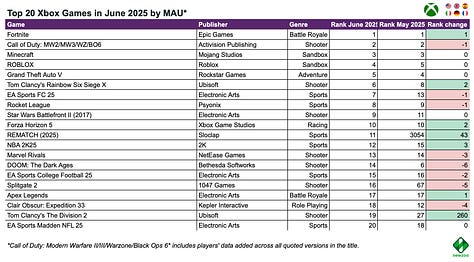

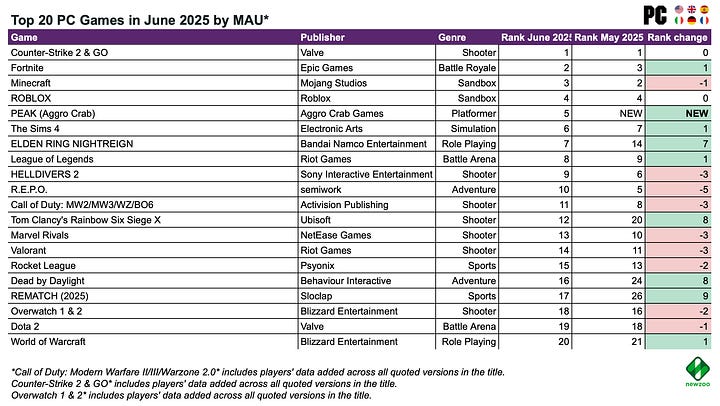

Newzoo tracks the markets of the US, UK, Spain, Germany, Italy, and France.

-

There are many new entries in the revenue ranking for June. Dune: Awakeningdebuted in 5th place, Rematch took 9th, Death Stranding 2: On the Beach landed at 15th, SCUM reached 17th (although the project entered Early Access back in 2018, version 1.0 was released in June), and Deltarune holds the 20th spot.

-

After a major update celebrating the project’s 5th anniversary, Valorant rose to 7th place in the rankings.

-

The collaboration between Dead by Daylight and Five Nights at Freddy’s led to the highest monthly revenue growth for the project since April 2020.

-

Of the newcomers in terms of revenue, two are independent IPs: Rematch and SCUM. The other three are either based on existing IPs (Dune: Awakening), sequels (Death Stranding 2: On the Beach), or spin-offs building upon the original game (Deltarune).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Notably, on PlayStation, MindsEye entered the top sales ranking at 18th. The developers managed to generate some initial revenue, but future sales are likely to disappoint given the game’s 2.3 out of 5 rating in the PS Store.

-

Lies of P saw a sharp jump in revenue, landing at 20th. This is linked to the release of its prequel, Lies of P: Overture.

-

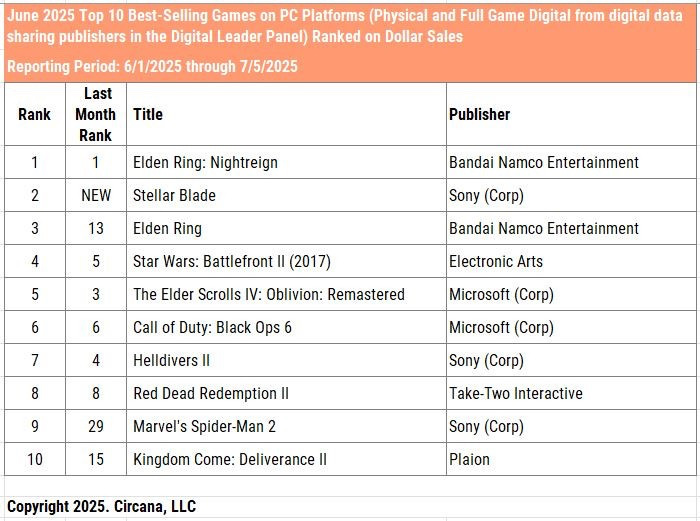

On the PC ranking, there are seven newcomers. This includes games already mentioned in the overall top: Dune: Awakening (#1 on PC in June), SCUM (#7), Rematch (#8), Deltarune (#13), along with platform-specific debuts: PEAK (10th), Stellar Blade (14th), and Date Everything!(17th).

-

For Nintendo platforms, for the first time in a long while (due to the inclusion of Nintendo Switch 2 projects), there are many new titles in the chart. These include Mario Kart World (2nd place, behind only Fortnite), Deltarune (9th), Cyberpunk 2077 (14th), and Date Everything!(15th).

-

The top 20 by MAU included late-May releases Elden Ring Nightreign and Splitgate 2. Among other new entries is Rematch, though Newzoo appears to be counting the closed beta audience.

-

On PC, PEAK appeared as a leading game by MAU, taking the 5th spot—surpassing Marvel Rivals, Valorant, Overwatch, DOTA 2, and other popular live-service hits.

-

On Nintendo Switch 2, there are three new titles: Mario Kart World (1st place), Nintendo Switch 2 Welcome Tour (8th), and Deltarune (20th).

-

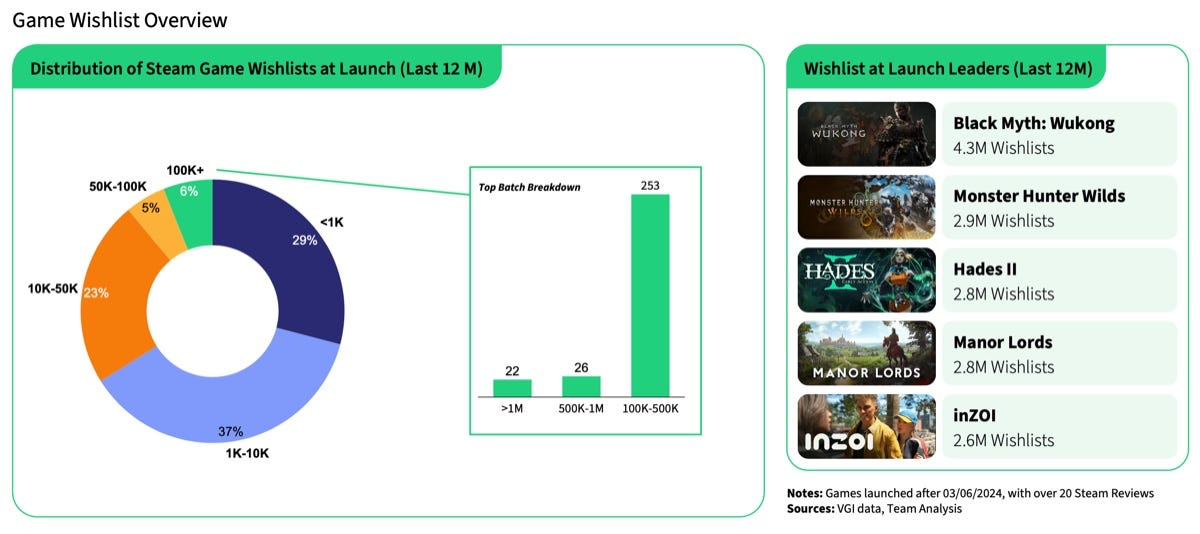

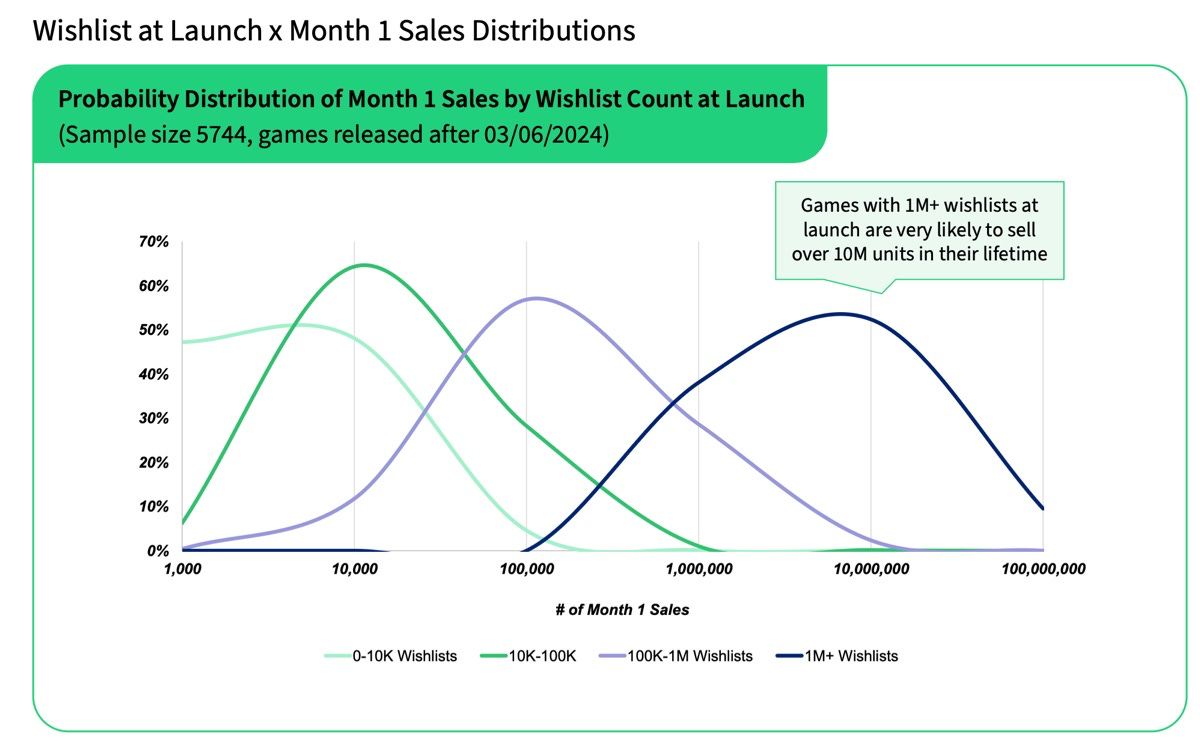

Only 6% of projects in the last 12 months reached over 100,000 wishlists. That’s 301 projects, with 22 of them surpassing 1 million wishlists.

-

66% of games have fewer than 10,000 wishlists.

-

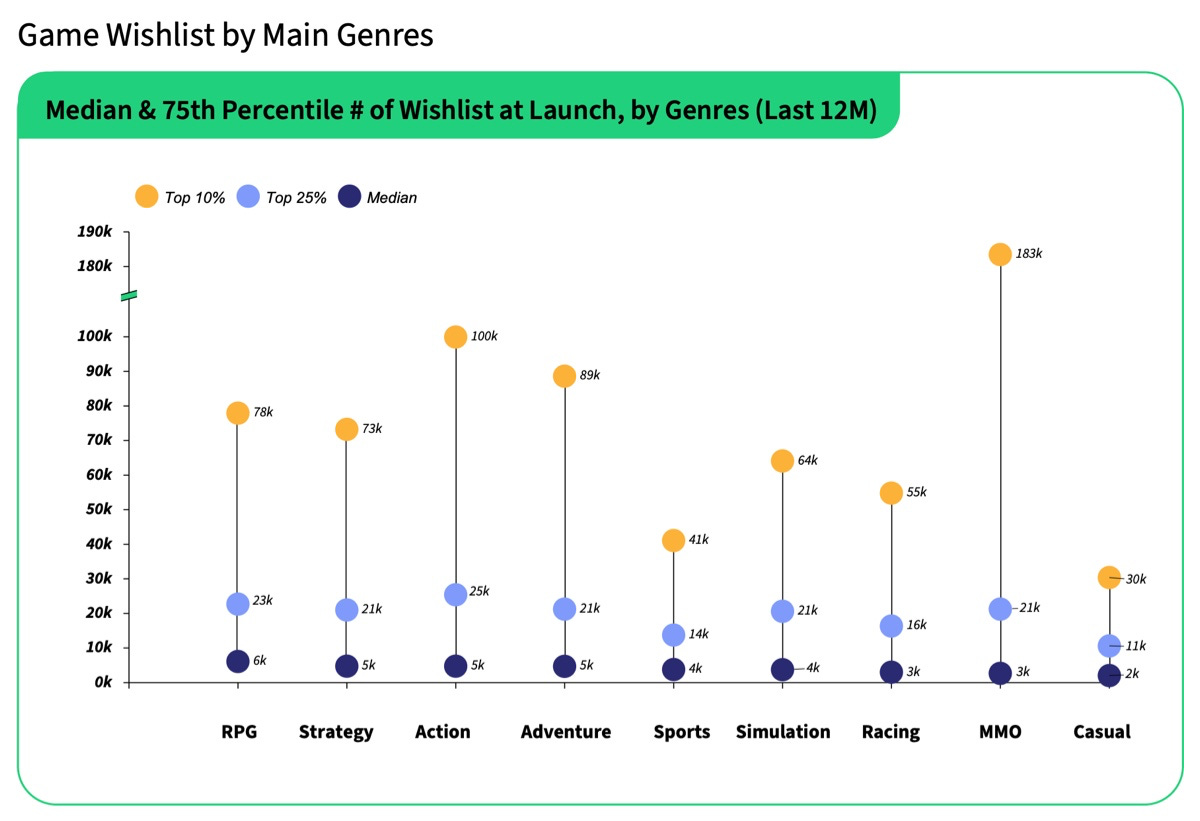

RPGs, strategy, and action games have a higher median number of wishlists. The lowest are MMOs and casual games. At the same time, if you look at the top 10% of MMOs by wishlists in the last 12 months, their number (183,000) is the highest among all genres. This shows that audience interest is concentrated among several large projects.

-

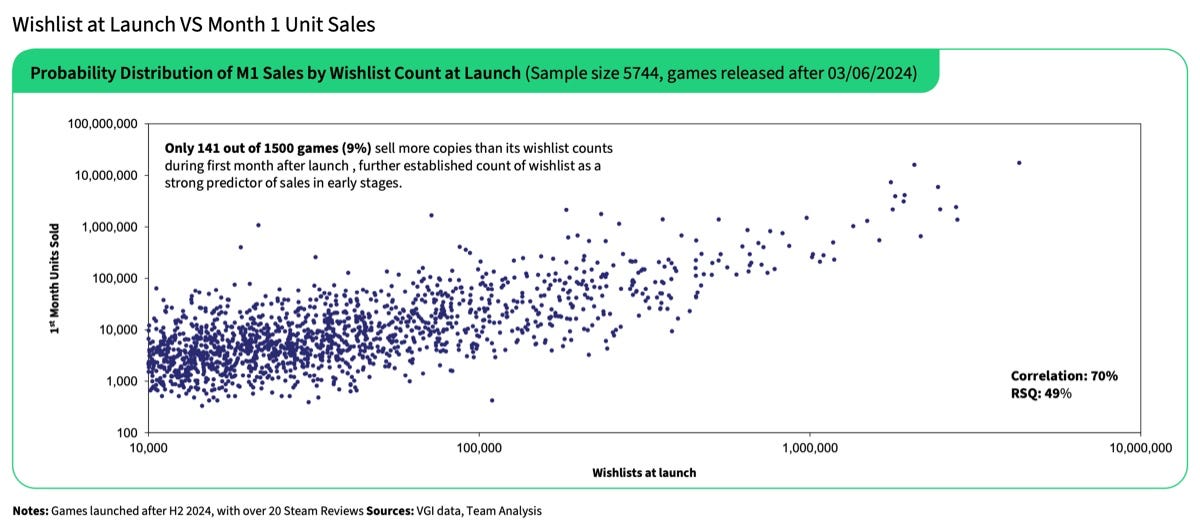

There is a direct correlation between the number of wishlists and sales in the first month.

-

A small number of wishlists is not a death sentence, but the chances of such projects selling significant numbers are lower.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

100,000 wishlists is a threshold that significantly increases a project’s chances for a strong start.

-

Video Game Insights notes that only 141 games out of 1,500 (9%) sold more copies than they had wishlists at launch.

❗️A correlation of 70% indicates that first-month sales depend on the number of wishlists. RSQ (coefficient of determination) points out that wishlist numbers can explain 49% of sales variance. The remaining 51% is attributable to other factors.

-

At the same time, this prediction method works well for projects with more than 100,000 wishlists. For smaller projects, the dependence is far from obvious.

-

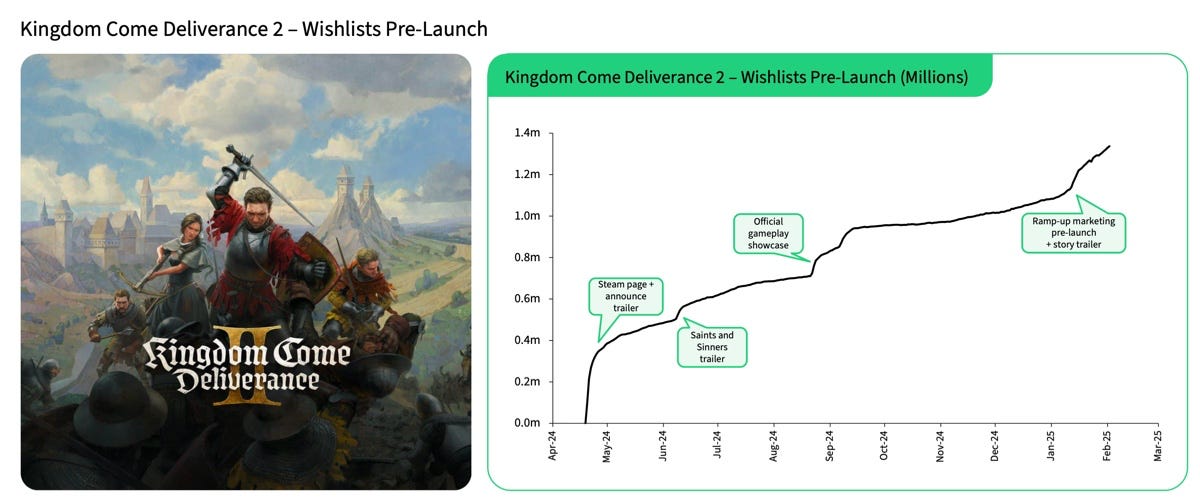

Most top projects on Steam open their pages six months to a year before release.

-

Successful projects generally collect more than 70% of their wishlists in the four months leading up to launch. However, there are also successful cases with games that had a shorter marketing campaign (Indiana Jones and the Great Circle, Marvel’s Spider-Man 2, Final Fantasy XVI).

-

Specifically, the number of wishlists for Kingdom Come: Deliverance 2 increased with each new trailer. Three months before release, the game had already gathered 72% of all wishlists it would have by launch.

-

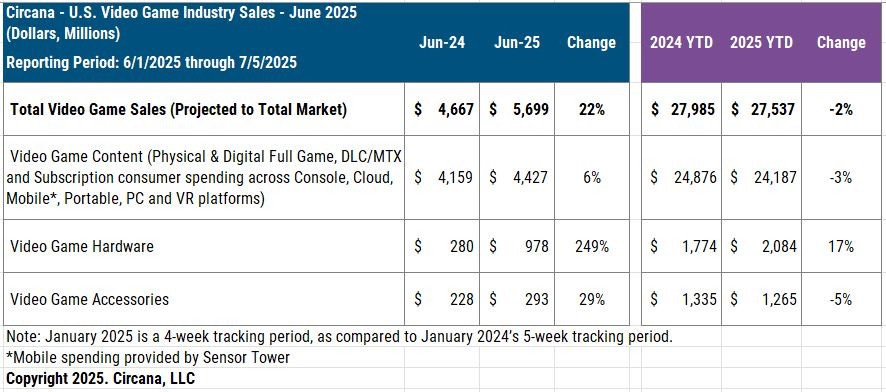

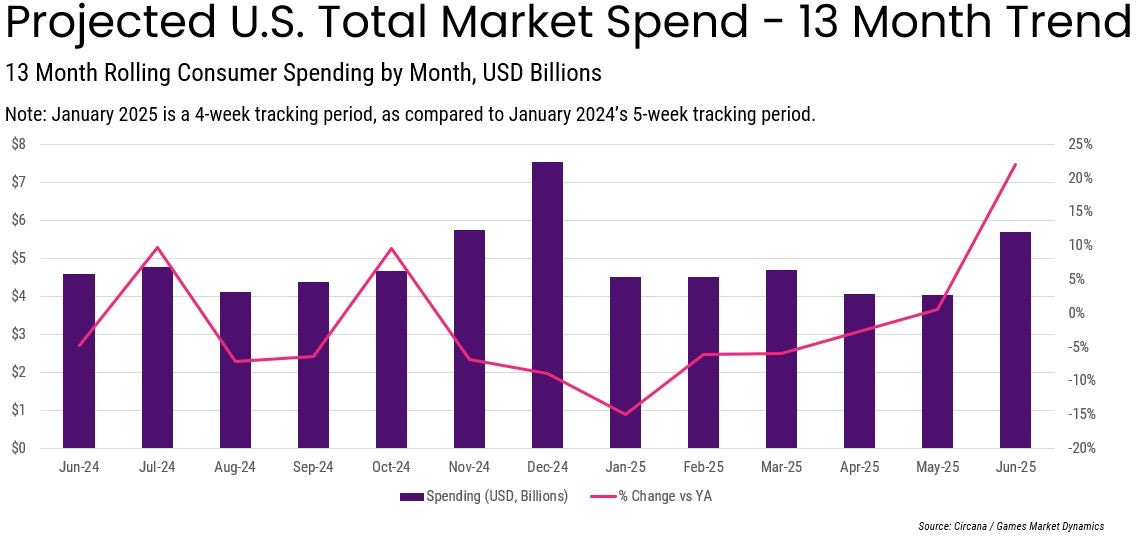

In June, the total video game market volume reached $5.699 billion, up 22% year over year.

-

Video game content sales grew 6% YoY to $4.427 billion.

-

Console sales surged 249% YoY to $978 million, setting a historical June record (previous was $608 million in June 2008).

-

1.6 million Nintendo Switch 2 units were sold in June, the highest debut month in U.S. market history. The previous record belonged to the PS4 with 1.1 million units sold in November 2013.

-

PlayStation 5 ranked second after NS2 in sales for the month and remained the year-to-date leader in total units sold across the first six months of 2025.

-

Accessories sales increased 29% YoY to $293 million, marking another all-time June record.

-

32% of all Nintendo Switch 2 buyers purchased the Nintendo Switch 2 Pro Controller.

-

June 2025 was the strongest June by revenue since 2019.

-

Despite strong June results, total U.S. gamer spending in the first six months of 2025 ($25.537 billion) was 2% lower than during the same period in 2024.

-

Non-mobile subscriptions continued to grow, reaching $562 million in June 2025, up 32% year over year. This is an all-time monthly record for the category.

-

Notably, some of this growth was driven by Star Wars: The Old Republic.

-

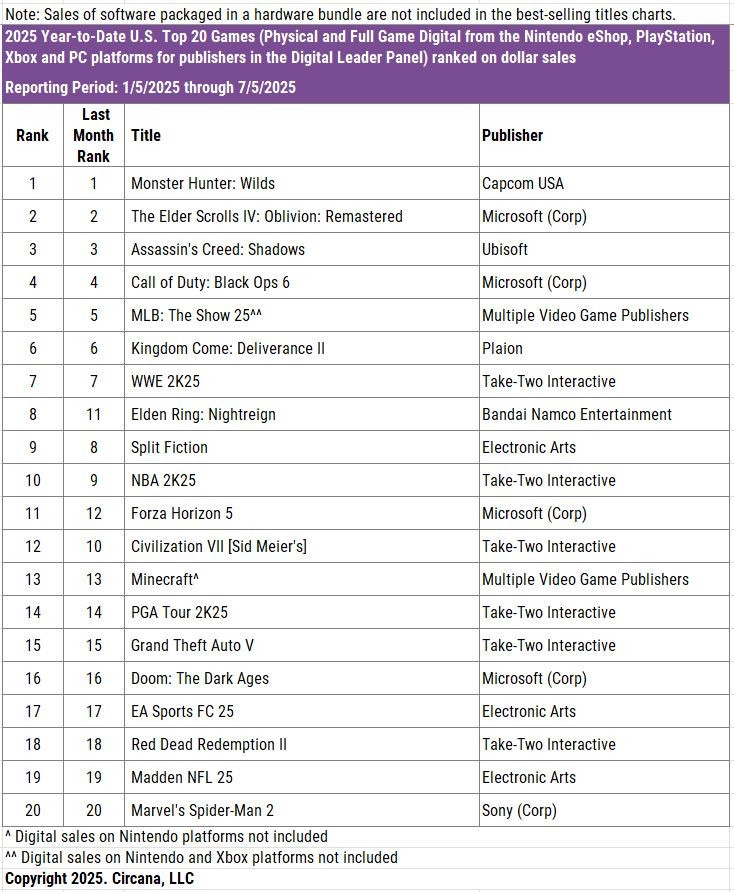

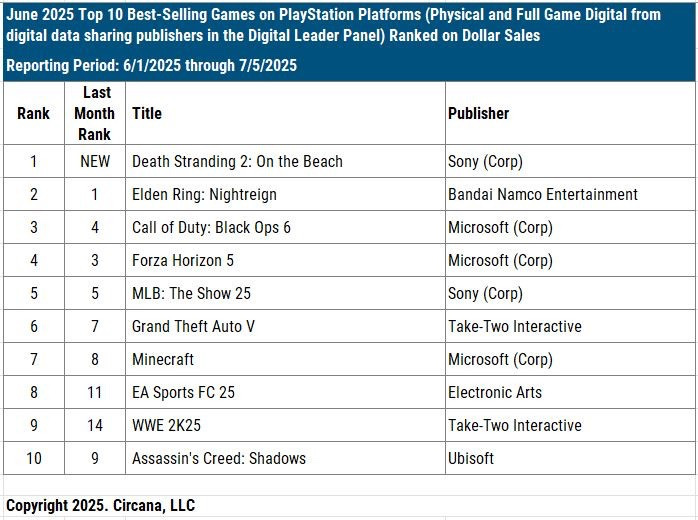

Several new titles led sales: Death Stranding 2: On the Beach (2nd place), Mario Kart World (3rd place — without counting digital sales), and Rune Factory: Guardians of Azuma (10th place).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Circana reports 82% of Nintendo Switch 2 buyers also bought Mario Kart World, either in a bundle or separately.

-

Strong sales were also noted for Stellar Blade (5th place, new on PC) and Cyberpunk 2077 (18th place, debut on Nintendo Switch 2).

-

The best-selling titles for the first six months of 2025 remained unchanged: Monster Hunter: Wilds, The Elder Scrolls IV: Oblivion – Remastered, and Assassin’s Creed: Shadows.

-

Top performers in mobile remained MONOPOLY GO!, Royal Match, and Last War: Survival.

-

Driven by Pokemon GO Fest, Pokemon GO revenue surged, entering the top 10.

-

Death Stranding 2: On The Beach was PlayStation’s best-selling title in June.

-

Final Fantasy XVI’s timed exclusivity ended, and the game launched on Xbox, taking 4th in June’s chart.

-

Nintendo Switch 1 and 2 saw many new releases: Mario Kart World, Cyberpunk 2077, Rune Factory: Guardians of Azuma, Street Fighter 6, and Bravely Default: Flying Fairy HD Remaster. Sales for The Legend of Zelda from the first Nintendo Switch also significantly increased, likely with new console owners trying classic hits.

-

Among new releases, only Stellar Blade made it into the PC sales chart.