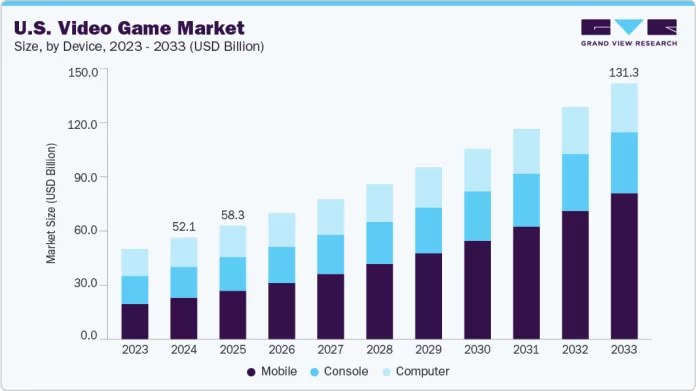

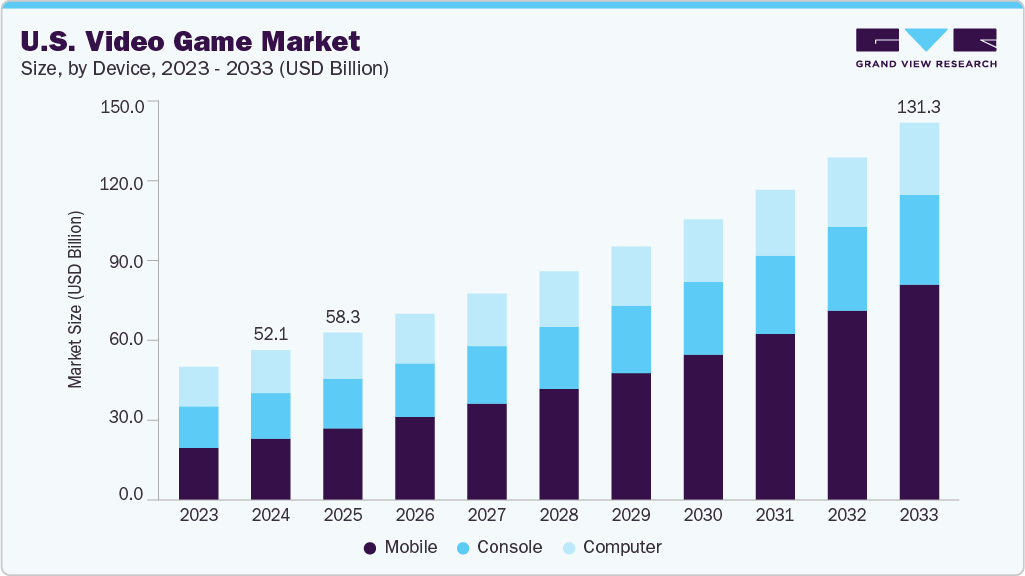

The U.S. video game market size was estimated at USD 52.13 billion in 2024 and is projected to reach USD 131.30 billion by 2033, growing at a CAGR of 10.7% from 2025 to 2033. The growth is primarily driven by increasing consumer demand for immersive entertainment experiences, rapid graphics and gameplay technologies advancements, and the expanding influence of online multiplayer and esports ecosystems. The rise in high-speed internet accessibility, cloud gaming services, and mobile gaming platforms significantly enhances user engagement and broadens market reach. The integration of artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) is revolutionizing game development, offering highly personalized and interactive content. These innovations are attracting new demographics and increasing user retention and in-game spending.

The rapid evolution and deployment of cloud gaming platforms and immersive technologies fundamentally transform the U.S. video game industry. Advanced systems such as AI-driven game engines, real-time streaming infrastructures, and virtual/augmented reality (VR/AR) interfaces enable developers and publishers to deliver highly engaging and accessible gaming experiences. The demand for seamless, low-latency gameplay across multiple devices continues to grow, thereby accelerating the expansion of the U.S. video game industry.

Additionally, shifting consumer demographics and the rising popularity of eSports and live-streaming platforms drive demand for interactive and socially connected gaming ecosystems. The proliferation of platforms like Twitch and YouTube Gaming has created new revenue streams and community-driven content models. This evolution aligns with the increasing preference for multiplayer and cross-platform gaming experiences, positioning video games as a dominant force in entertainment and digital media and fueling market growth.

Furthermore, the rising adoption of video games in educational technology, corporate training, and mental wellness applications significantly contributes to market expansion. Gamification of learning modules, simulation-based training tools, and therapeutic games for stress relief and cognitive development are gaining traction across non-traditional user segments. Federal and state-level educational initiatives and corporate investments in digital upskilling are encouraging the integration of video games into broader societal functions. This convergence of entertainment, education, and wellness fosters long-term growth and innovation in the U.S. video game industry.

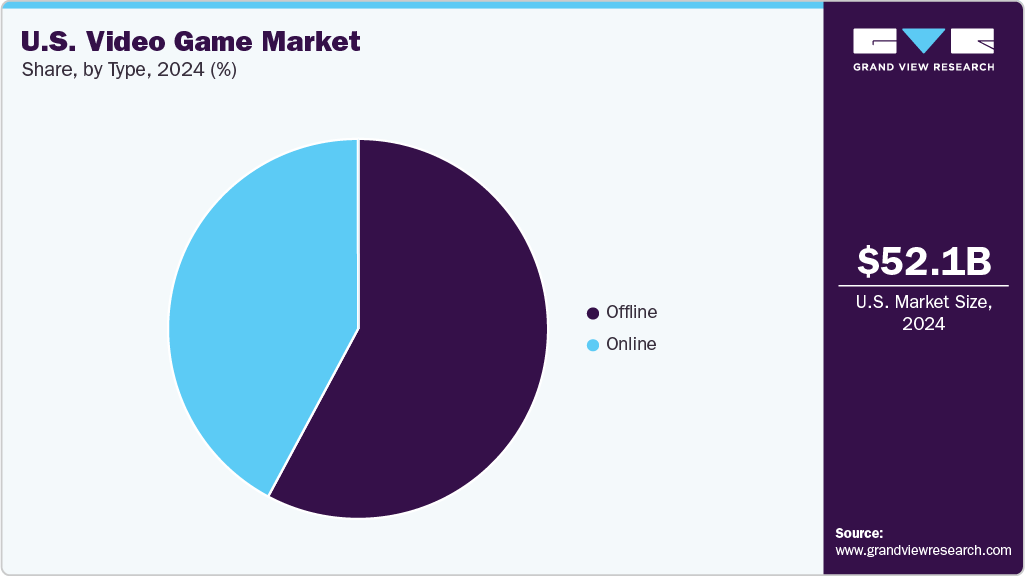

Type Insights

The offline segment dominated the market and accounted for the largest market share, over 57%, in 2024. The continued popularity of single-player titles, enhanced graphics, and immersive storytelling experiences have significantly influenced the growth of this segment. Many consumers prefer offline gaming due to the uninterrupted gameplay, absence of latency issues, and lack of reliance on stable internet connectivity. The rise of retro and console-based gaming, along with privacy-conscious users seeking secure, self-contained entertainment, further drives demand for offline video games in the U.S. market.

The online solution segment is expected to witness the highest CAGR of over 13 % from 2025 to 2033. The increasing popularity of multiplayer gaming fuels this growth, the rise of cloud-based platforms, and the widespread adoption of high-speed internet and 5G connectivity. The convenience of instant access, frequent content updates, and cross-platform gameplay enhances user engagement and retention. Growing investments in live-service models and in-game monetization strategies by major developers are boosting revenue potential. The ease of digital distribution and the rising demand for socially interactive and immersive gaming experiences further propel the online segment’s expansion.

Device Insights

The console segment accounted for a significant market share in 2024, driven by its powerful hardware capabilities, exclusive game titles, and immersive gaming experiences tailored for home entertainment. Consoles offer optimized graphics performance, reliable gameplay without latency issues, and integration with online multiplayer networks, making them the preferred choice for both casual and hardcore gamers. The rise in 4K and HDR-compatible TVs has further enhanced the visual appeal of console gaming, while bundled services such as Game Pass and PlayStation Plus have increased value for consumers. The strong brand loyalty and ecosystem lock-in created by major players continue to reinforce the dominance of the console segment in the U.S. video game industry.

The mobile segment will witness the highest CAGR from 2025 to 2033. This growth is driven by the widespread adoption of smartphones, increasing mobile internet penetration, and the growing popularity of free-to-play and hyper-casual games. Advancements in mobile hardware, such as high-refresh-rate displays and powerful GPUs, enhance gaming performance and attract a broader audience. In-app purchases, social connectivity, and cross-platform integration create new revenue streams and deeper user engagement, making mobile gaming the fastest-growing device segment.

Key U.S. Video Game Company Insights

Some of the key players operating in the market include Microsoft and Sony Interactive Entertainment Inc., among others.

-

Microsoft offers a comprehensive gaming ecosystem through its Xbox consoles, Xbox Game Pass subscription service, and cloud gaming platform (Xbox Cloud Gaming). Its acquisition of leading studios like Bethesda and Activision Blizzard has significantly expanded its exclusive content portfolio, reinforcing its dominance in the market.

-

Sony Interactive Entertainment Inc. provides cutting-edge gaming experiences through its PlayStation consoles, exclusive AAA titles, and PlayStation Network services. The company’s focus on immersive technologies like haptics, VR integration, and cinematic storytelling continues to drive consumer loyalty and market leadership in the U.S. video game industry.

Riot Games, Inc. and Insomniac Games, Inc. are some of the emerging market participants in the market.

-

Riot Games, Inc. develops competitive online games such as League of Legends and Valorant, which have become cultural phenomena in the U.S. gaming and eSports arenas. Through constant content updates, player engagement strategies, and major eSports tournaments, Riot is emerging as a leading force in live service and multiplayer gaming.

-

Insomniac Games, Inc. creates high-quality, narrative-driven PlayStation exclusives like Marvel’s Spider-Man and Ratchet & Clank. With strong storytelling, innovative gameplay mechanics, and consistent critical acclaim, Insomniac has rapidly emerged as a flagship studio, contributing to Sony’s growing influence in the U.S. video game market.

Key U.S. Video Game Companies:

- Microsoft

- Sony Interactive Entertainment Inc.

- Nintendo of America Inc.

- Activision Blizzard

- Electronic Arts Inc.

- Epic Games, Inc.

- Take-Two Interactive Software, Inc.

- Valve Corporation

- Riot Games, Inc.

- Insomniac Games, Inc.

Recent Developments

-

In May 2025, Microsoft secured a major regulatory victory by acquiring Activision Blizzard. This development strengthens Microsoft’s presence in the U.S. video game market by expanding its portfolio of popular gaming titles and enhancing its leadership in subscription-based and cloud gaming services. The acquisition supports the evolution of interactive entertainment and positions Microsoft as a key driver of innovation within the U.S. gaming ecosystem.

-

In June 2025, Sony Interactive Entertainment Inc. hosted its State of Play livestream to unveil a lineup of upcoming PlayStation 5 titles tailored for the U.S. gaming audience. As part of its Days of Play 2025 campaign, Sony introduced exclusive discounts and bonus games and expanded PlayStation Plus content offerings. These efforts reinforce Sony’s commitment to enriching the U.S. video game market through continuous content innovation and player engagement.

-

In May 2025, Valve Corporation rolled out a major firmware update for the Steam Deck, enhancing system stability, performance, and compatibility. While major new hardware was launched, these improvements aimed to strengthen Valve’s position in the U.S. video game industry. The update supports the broader development of the video game ecosystem by promoting high-quality portable PC gaming experiences for consumers.

U.S. Video Game Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 58.28 billion |

|

Revenue forecast in 2033 |

USD 131.30 billion |

|

Growth rate |

CAGR of 10.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2025 to 2033 |

|

Report Product |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Device, type |

|

Country scope |

U.S. |

|

Key companies profiled |

Microsoft; Sony Interactive Entertainment Inc.; Nintendo of America Inc.; Activision Blizzard; Electronic Arts Inc.; Epic Games, Inc.; Take-Two Interactive Software, Inc.; Valve Corporation; Riot Games, Inc.; Insomniac Games, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet you exact research needs. Explore purchase options |

U.S. Video Game Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. video game market report based on device and type:

-

Device Outlook (Revenue, USD Billion, 2021 – 2033)

-

Console

-

Mobile

-

Computer

-

-

Type Outlook (Revenue, USD Billion, 2021 – 2033)

-

Online

-

Offline

-