TLDR

- Ethereum failed to maintain support above $3,700 despite SharpLink Gaming purchasing 83,000 ETH worth approximately $300 million

- US spot Ethereum ETFs recorded their largest single-day outflow of $465 million on Monday

- SharpLink Gaming increased total ETH holdings to 521,939 tokens and allocated $264.5 million to expand purchases further

- ETH futures market saw $108 million in liquidations over 24 hours, with $74 million from long positions

- Critical support level remains at $3,094, with analysts watching this price point for future trend direction

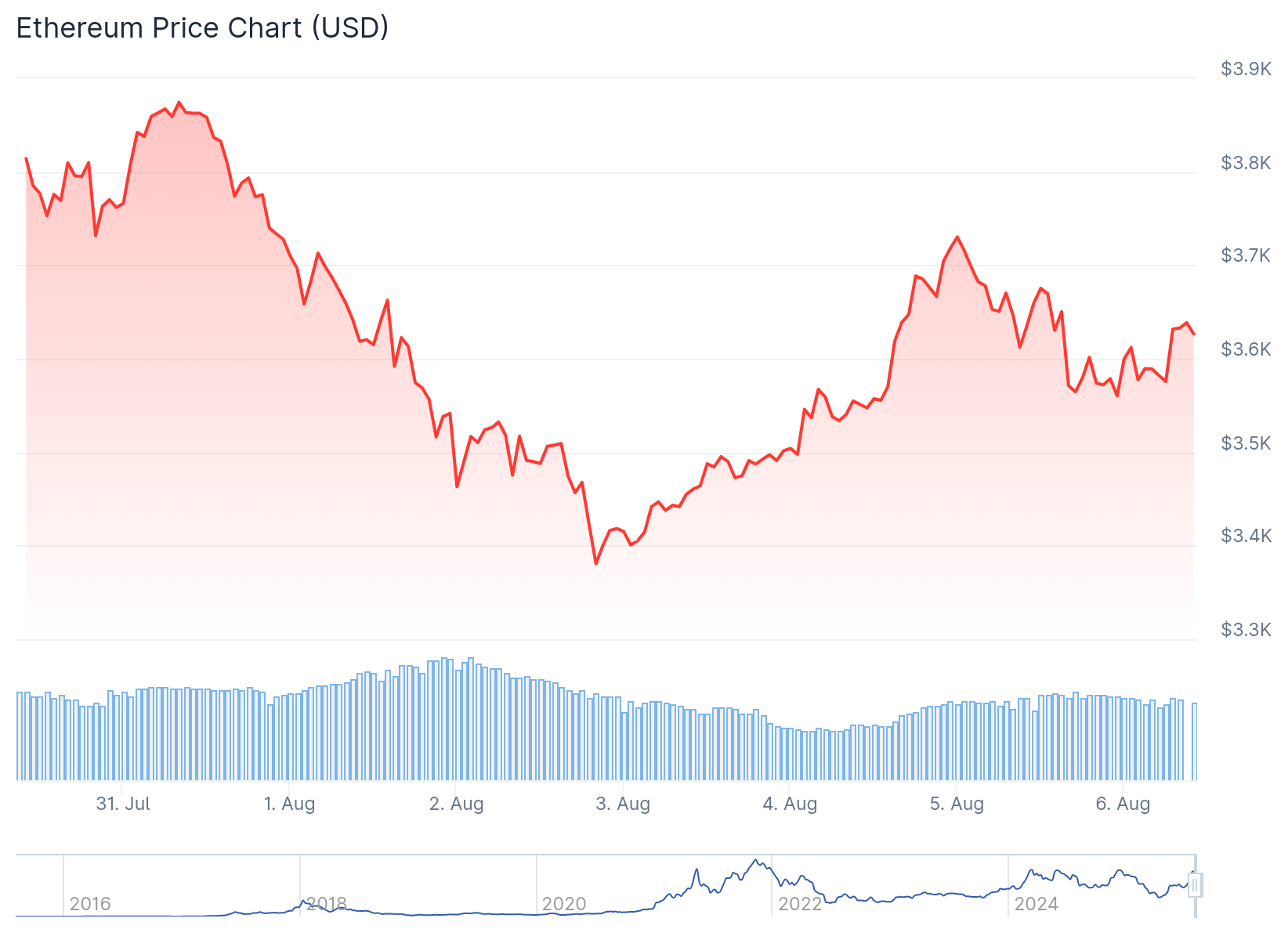

Ethereum price analysis shows continued weakness as ETH struggles to maintain the $3,700 support level. The world’s second-largest cryptocurrency faces downward pressure despite corporate buying from SharpLink Gaming.

ETH price dropped below $3,700 after failing to sustain early week gains. The cryptocurrency started with a 6% rally but could not break through key resistance levels.

SharpLink Gaming purchased 83,561 ETH tokens last week in a major corporate acquisition. The esports marketing company increased total Ethereum holdings to 521,939 tokens as of August 3.

SharpLink(@SharpLinkGaming) bought another 18,680 $ETH($66.63M) 15 minutes ago.

SharpLink currently holds 498,711 $ETH($1.81B).https://t.co/cW8EvzSFxt pic.twitter.com/OHCkM4eWUY

— Lookonchain (@lookonchain) August 4, 2025

The corporate purchase failed to boost Ethereum price above $3,700 resistance. Instead, ETH faced selling pressure from institutional investors through exchange-traded funds.

US spot Ethereum ETFs experienced record outflows of $465 million on Monday. This marked the largest single-day withdrawal according to SoSoValue data.

The massive ETF outflow ended a 20-day streak of inflows totaling $5.3 billion. Institutional selling pressure overwhelmed corporate buying demand during Tuesday’s trading session.

SharpLink Gaming allocated $264.5 million to an at-the-market facility following their ETH purchase. The company adopted an Ethereum treasury strategy through a $425 million private placement in May.

Ethereum Price Technical Analysis

ETH price found support near the $3,400 zone before recovering above $3,500. The cryptocurrency broke above the 50% Fibonacci retracement level from recent highs.

Bulls pushed Ethereum price above $3,700 but met resistance at $3,750. The 61.8% Fibonacci retracement level acted as strong resistance for ETH buyers.

$ETH: The daily chart shows that the price is holding well above micro support. The trend remains up as long as the $3094 level is being respected and the price avoids a decisive break below this level. pic.twitter.com/7asyfF9qof

— More Crypto Online (@Morecryptoonl) August 5, 2025

Ethereum price subsequently broke below a bullish trend line with support at $3,620. The breakdown occurred on hourly charts showing weakening momentum.

ETH now trades below the 100-hourly Simple Moving Average at $3,600. Price action shows bearish signals across multiple technical indicators.

The hourly MACD gains momentum in bearish territory for Ethereum price. RSI dropped below the 50 level indicating continued selling pressure.

Immediate resistance for ETH sits at $3,620 with major resistance at $3,750. A clear break above $3,750 could push Ethereum price toward $3,820.

Further upside targets include the $4,000 psychological level and $4,120 resistance zone. Bulls need sustained buying pressure to reach these levels.

Corporate Ethereum Holdings Expand

SharpLink Gaming now ranks second among publicly traded companies with large ETH treasuries. BitMine leads corporate holdings with over 833,100 Ethereum tokens.

Combined ETH treasury vehicles currently hold more than 1.9 million tokens. Corporate demand continues growing despite recent price weakness.

Most of SharpLink’s Ethereum holdings are staked to generate rewards. The company earned 929 ETH in staking rewards since June.

SharpLink applied to increase their ATM facility to $6 billion with SEC approval. This funding would support additional Ethereum purchases.

The corporate treasury trend follows Bitcoin adoption strategies by major companies. Ethereum price benefits from long-term corporate holding strategies.

ETH futures market reflected increased volatility with $108 million in liquidations. Long position liquidations totaled $74 million over 24 hours.

Short liquidations reached $34 million according to Coinglass data. The liquidation activity shows heightened uncertainty among ETH traders.

Downside risks for Ethereum price include support breaks below $3,620. Initial support sits at $3,550 with major support at $3,510.

A break below $3,510 could push ETH toward $3,420 or $3,350 support levels. Bears target lower support zones if selling continues.

Analysts consider $3,094 the critical support level for Ethereum price trend. ETH must hold above this level to maintain bullish structure.