From the massive success of Monster Hunter Wilds and Stellar Blade to the most-watched VTuber debut in history, gaming in Japan and Korea is more of a cultural cornerstone than ever. As the third and fourth largest games markets by revenue in the world, both countries present their own opportunities and challenges for companies hoping to tap into this culture.

Niko Partners has tracked Japan and South Korea, collectively known as East Asia game market, for the past 8 years. Both have seen massive growth in the past decade driven by high consumption, strong domestic game industry, impressive technological adoption, and growing societal fascination with games as a major entertainment vehicle. Although we project a slight decline in East Asia this year, due to global issues affecting both countries, the region still represents a huge opportunity for companies who can navigate the market. Read on to understand the unique localization insights needed to find success in the world’s third and fourth largest video games market, respectively.

Japan and Korea to reach $30.3 billion market size by 2029

According to our East Asia Market Model and 5-Year Forecast, the region generated $29.1 billion in games revenue in 2024, down 3.1% YoY. Revenue is expected to decline slightly to $28.5 billion in 2025, although we project a rebound and market growth in 2026. The current decline is a combination of weakened currencies against the US dollar and an economic slowdown in the face of ongoing global trade issues. There are many more details disclosed in the Market Model reports.

Key highlights from the report include:

- The East Asia video game market is projected to decline by 2.3% in 2025 to $28.5 billion. The market is expected to rebound and grow to $30.3 billion in 2029 at a 5-year CAGR of 0.8%.

- The number of gamers in the East Asia video game market are projected to grow by 1.3% in 2025 to 98.4 million. The gamer population is also expected to see stable growth, reaching 101.7 million by 2029 at a 5-year CAGR of 0.9%.

- Japan’s ARPU is expected to reach $21.82 while Korea’s ARPU is expected to reach $30.77, the highest among all of the Asian markets that Niko cover.

Japan and Korea: demographic shifts and rising engagement

Our East Asia Gamer Behavior & Market Insights Reports, which includes a survey of 1,090 gamers, provide key insights on player demographics, behavior, and engagement. We produce individuals reports for each market on an annual basis to help clients understand developments and opportunities in the region. For those looking to dive deeper into their specific target audience, NikoIQ provides gamer survey data across all 13 markets that we track.

Some findings:

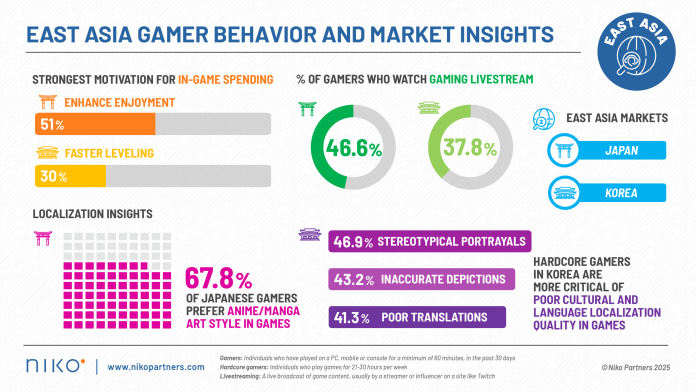

- 46.6% of Japanese gamers and 37.8% of Korean gamers watch gaming related video or livestream content.

- Japanese gamers and Korean gamers have the lowest propensity to spend on OOA platforms among all the Asian markets that Niko covers. This is both a challenge and opportunity for third party payment providers that want to enter the lucrative game payment markets in both countries.

Fill out this form below to download select key takeaways from the report

Popular genres and platform insights

One trend that has remained consistent since we started tracking East Asian markets is the dominance of RPG titles for PC and mobile. Korean gamers prefer the online variety, MMORPGs, compared to single player RPGs popular among Japanese gamers.

Good localizations is the recipe behind Ghost of Tsushima’s success in Japan and Umamusume Pretty Derby frenzy in Korea

Localization insights are needed to find success in the market

Domestic and regionally developed titles have long enjoyed the upper hand in both markets, in order to find success insights on localization strategy that can help tip the balance. Each market is home to different gamer tastes and preferences when it comes to games – knowing what these are helps companies navigate the playing field. Globally successful games might not always find easy entry to the markets without thoughtful localization.

Good localizations is the recipe behind Ghost of Tsushima’s success in Japan and Umamusume Pretty Derby frenzy in Korea

Some insights about localizations from the Gamer Behavior report:

- Above 40% of hardcore gamers in Korea are more sensitive to poor game localization attempts, notably with stereotypical and inaccurate portrayals of Korean culture, and poor translations.

- 8% of Japanese gamers prefer games in the anime/manga art style, with the share even stronger for gamers above 25 years old.

- Esports tournaments serve as an effective marketing channel for Korean male gamers, with 24.4% preferring it compared to just 11.4% for female gamers.

An online knowledge base for everything East Asia – NikoIQ

NikoIQ is our online knowledge base of the most trusted video game market data and insights across Asia & MENA. The platform consolidates all our research in one place, providing you with our market models, forecasts, gamer insights, Knowledge Briefs, earnings analysis and ongoing insights for each market.

When looking to understand how best to approach the Japan & Korea markets, NikoIQ delivers the data and insights you need to act with confidence. Success in the region demands cultural understanding, localized execution, and data-driven planning. At Niko Partners, our research is designed to help clients navigate this landscape with syndicated reports, ongoing subscription services, and custom projects.

At Niko Partners, we provide in-depth research through syndicated reports, subscription-based insights, and tailored consulting—empowering our clients to make informed decisions in a dynamic Asia & MENA market. Get in touch to learn more about our special East Asia regional package.