![]()

As the Q2 earnings season gained traction last week, several major gaming companies, including Las Vegas Sands, Churchill Downs, and Boyd Gaming, released their quarterly financial results. Gaming stocks ended the week with mixed performance, with the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) slightly underperforming the broader S&P 500 Index for the second consecutive week.

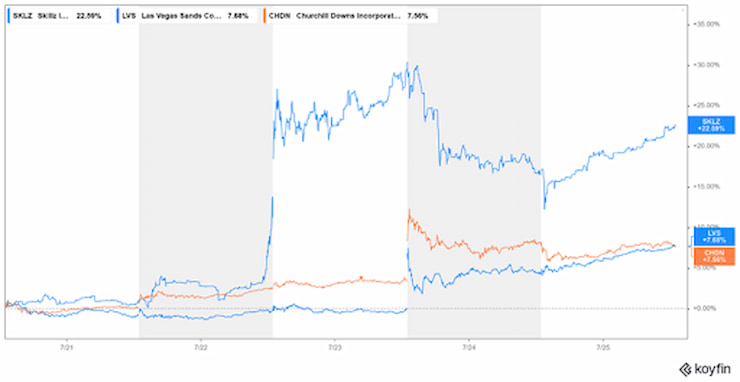

Still, stocks like Skillz and Las Vegas Sands were among the major gaming gainers last week. In contrast, Sea Limited and Genius Sports had a dismal week.

Last Week’s Top Gainers

Skillz (NYSE: SLKZ) | Weekly Gain: +22.3%

Two weeks after being the biggest weekly loser, Skillz was the best-performing stock in our coverage universe by a fair margin, gaining over 22% last week.

The growth is likely due to analysts’ optimism over Skillz’s renewed operational focus and turnaround efforts. The company has also recently launched a $75 million accelerator program to identify the next generation of skill-based mobile games.

That said, Skillz faces significant headwinds. Its paying monthly active users have fallen by over 41% over the last two years, and its $135 million market capitalization places it in microcap territory.

These factors, coupled with low trading volumes, make Skillz stock susceptible to significant price fluctuations, particularly in the absence of substantial company-specific news.

Notably, it was also part of the 2021 meme stock mania. Last week’s rise could be attributed to the return of the meme stock frenzy.

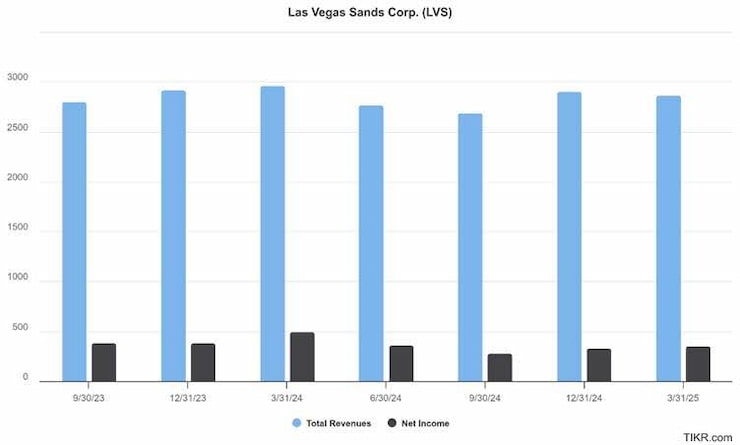

Las Vegas Sands (NYSE: LVS) | Weekly Gain: +7.7%

Las Vegas Sands stock gained around 7.7% last week as markets gave a thumbs-up to its Q2 earnings. The company reported revenues of $3.18 billion, well above analysts’ expectations of $2.84 billion. Net income jumped 30.6% to $461 million, also beating forecasts.

After the impressive Q2 results, several brokerages, including Mizuho, JPMorgan, Bank of America, Macquarie, and Barclays, raised their respective target prices for Las Vegas Sands.

Wall Street Zen went a step further and upgraded the stock from a “hold” to a “buy.”

Rank Group (LSE: RNK) | Weekly Gain: +7.7%

The UK-based casino and bingo operator Rank Group was among the other major gainers, rising 7.7% last week. The bulk of the gains came on Monday. That was likely due to legislative reforms for land-based casinos in the UK, which took effect on Tuesday.

While still down nearly 20% year-to-date, the stock rallied sharply early in the week as investors bet on improved operating conditions.

Churchill Downs (NASDAQ: CHDN) | Weekly Gain: +7.6%

Churchill Downs gained 7.6% last week after beating Q2 earnings. The company reported revenues of $934.4 million, which easily surpassed the $919.5 million that analysts were modelling.

The Earnings Per Share came in at $2.99, which is slightly ahead of the consensus estimate of $2.96.

The company announced a $500 million share buyback plan that further added to the optimism. With the Kentucky Derby operator diversifying into historical racing machines and other gaming ventures, including the purchase of a New Hampshire casino, analysts view CHDN as positioned for long-term growth.

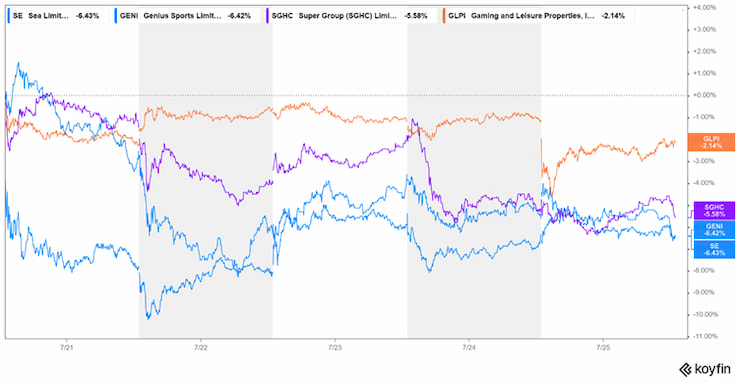

Top Losers

Sea Limited (NYSE: SE) | Weekly Loss: -6.4%

Tech conglomerate Sea Limited, parent of gaming studio Garena, fell 6.4% last week. That result made it the worst performer in our coverage of gaming stocks.

The results contrasted with the stock’s double-digit gains in the preceding week, amid optimism towards Asian tech following the easing of concerns around US-China chip exports.

The pullback appeared to be driven by profit-taking, although the company remains up over 48% year-to-date.

Analysts, including Jefferies, remain bullish, raising their target price to $180 based on improving e-commerce margins and growth prospects for Garena.

Genius Sports (NYSE: GENI) | Weekly Loss: -6.4%

Genius Sports also fell 6.4% last week. The decline is attributed to profit-taking, as the stock rallied in the previous month after expanding its partnership with the NFL.

Through the deal, Genius Sports will remain the league’s exclusive distributor of official data feeds and watch-and-bet services until the end of the 2029 season.

Although the stock experienced selling pressure last week, analysts remain optimistic. Northland Securities initiated coverage on the stock with a “buy” rating and a $14 target price, citing long-term monetization potential for its data rights portfolio.

Super Group (NYSE: SGHC) | Weekly Loss: -5.6%

Super Group, the parent company of Betway sportsbook, fell last week by 5.6% after a strong run since January. Earlier this month, the company announced its intention to exit the US, citing ongoing losses and increasing regulatory costs.

Improved profitability in international markets has driven the stock up recently, but last week saw modest selling pressure as investors locked in gains.

Gaming and Leisure Properties (NASDAQ: GLPI) | Weekly Loss: -4.1%

Gaming and Leisure Properties, a real estate investment trust specializing in gaming properties, reported mixed Q2 earnings last week. That caused its stock to decline by 4.1%.

While the profits matched expectations, revenue slightly fell short of forecasts. Following the earnings release, Stifel lowered the stock’s target price to $49.25 from $51.25, while maintaining its hold rating.

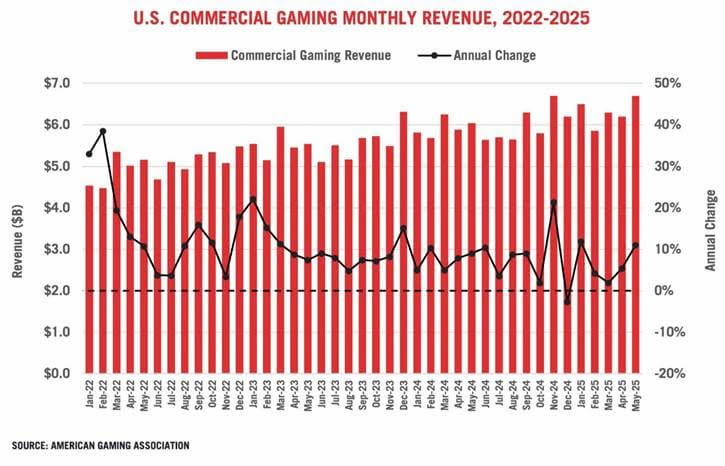

Other Key Industry Developments

The American Gaming Association released its May update last week. The data showed that the total commercial gaming industry revenue from traditional casino games, sports betting, and iGaming increased 10.9% year-over-year to $6.73 billion in May. It was the best May performance on record.

Examining the breakdown, land-based gaming revenues increased by 4.8% in May, while iGaming rose by 33%. Meanwhile, sports betting grew by 21.4%.

Boyd Gaming released its Q2 earnings last week and reported revenues of $1.03 billion in the second quarter. That was an increase of 6.9% from the corresponding quarter of the previous year.

The results exceeded the $981 million that analysts had expected. Its EBITDAR rose nearly 4% year-over-year to $357.9 million.