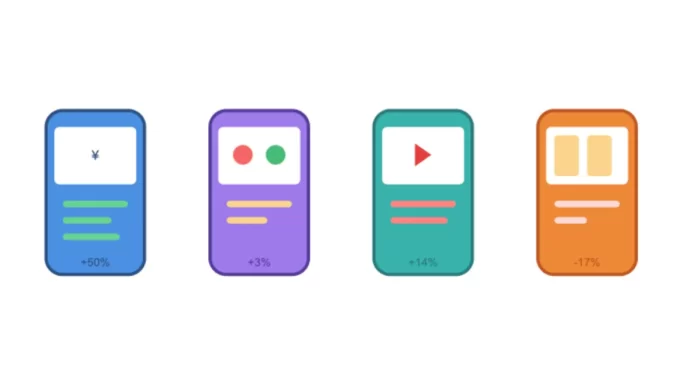

Japan’s mobile app economy is experiencing a significant transformation in 2025, with finance applications leading unprecedented growth while gaming apps maintain their traditional strength, according to the comprehensive Mobile App Trends 2025: Japan Edition report released July 23, 2025. The research, jointly conducted by Adjust and Sensor Tower, analyzed data from January 2023 to May 2025 across four key verticals: gaming, finance, entertainment, and comics.

According to the report, finance app installs in Japan surged 50% year-over-year in the first half of 2025, while sessions climbed 22%. This represents one of the strongest performance indicators across all app categories analyzed. The marketing intelligence community has closely tracked Japan’s evolving digital landscape, with finance apps emerging as a standout growth driver in the world’s third-largest consumer app spend market, which reached $16.5 billion in 2024.

Finance apps drive market transformation

The finance vertical’s remarkable performance stems from sustained momentum that began building in Q4 2024. According to the data, finance apps experienced notable spikes in October 2024 with 49% growth, followed by November at 15% and December at 45% growth compared to yearly averages. This upward trend extended into 2025, with April installs up 45% compared to the first-half average.

Banking applications led the finance surge with installs and sessions rising 33% and 27% year-over-year respectively. Payment apps posted steady gains with 12% install growth and 15% session increases, while cryptocurrency apps demonstrated strong install growth at 21% despite a 3% decline in sessions. Stock trading applications showed particularly strong engagement patterns, with sessions surging 36% despite a 35% decline in installs.

The report indicates that iOS dominates finance app engagement in Japan, accounting for 56% of installs and 62% of sessions. This platform preference becomes more pronounced in specific subcategories, with crypto applications showing 64% installs and 74% sessions on iOS, while banking apps demonstrate 62% and 74% respectively.

Gaming maintains resilient performance

Japan’s gaming sector, traditionally the cornerstone of the mobile app market, demonstrated consistent performance with installs rising 3% year-over-year in the first half of 2025 and sessions holding steady with a 0.3% lift. This stability contrasts with global trends where gaming installs declined 1% while sessions rose 2%, and U.S. markets where both metrics declined.

According to the methodology outlined in the report, gaming data encompasses analysis from Adjust’s top 5,000 apps and total dataset coverage across approximately 250 countries. The research reveals significant variations across gaming subgenres, with card games climbing 27% in installs and 127% in sessions, while casino games led overall growth with a 138% install surge.

Pokémon TCG Pocket dominated both download and consumer spending rankings, reflecting the sustained appeal of franchise-based mobile gaming. The gaming demographic data shows 66.4% of downloads came from male users, with the 25-34 age group representing 31% of the user base.

Gaming app session lengths averaged 26.97 minutes in the first half of 2025, with RPGs leading at 40 minutes per session. iOS users drove 52% of gaming installs and 65% of sessions, indicating platform preference patterns that influence monetization strategies.

Entertainment fragmentation drives specialized growth

The entertainment vertical experienced substantial growth with installs increasing 14% year-over-year in the first half of 2025 and sessions rising 5%. This growth was significantly outpaced globally, where installs surged 55% and sessions increased 31%, while U.S. markets saw 37% install growth alongside 47% session increases.

According to the report’s analysis, Japan’s entertainment landscape is being reshaped by two high-engagement verticals: short drama apps and over-the-top (OTT) streaming platforms. Between August 2023 and June 2024, Japanese users spent $13.22 million on short drama apps, accounting for 5.13% of global revenue despite representing just 2.16% of downloads.

The data reveals that short drama apps achieve remarkable monetization efficiency with revenue per download sitting at $4.13, outperforming many leading mobile games. These applications specialize in vertical, 1-2 minute episodes featuring revenge plots and emotional cliffhangers that particularly appeal to women aged 25-44.

OTT platforms demonstrate continued market expansion, with the Japan streaming market valued at $9.78 billion in 2025 and projected to reach $20.18 billion by 2032, representing a 12.83% compound annual growth rate. Netflix’s recent programmatic advertising expansion into Japan illustrates the growing sophistication of the streaming advertising ecosystem.

Comics maintain cultural significance amid decline

Japan’s comics app ecosystem, built on the country’s deep cultural affinity for manga, experienced install declines of 17% year-over-year in the first half of 2025, with sessions dropping 4%. However, engagement metrics remained strong with session lengths reaching 17.57 minutes, indicating high user loyalty despite acquisition challenges.

The vertical shows unique platform distribution patterns, with Android accounting for 60% of installs compared to iOS at 40%. However, iOS users demonstrate higher engagement, generating 69% of all sessions while Android contributes 31%. This engagement disparity suggests different monetization potentials across platforms.

According to the report, comic apps experienced a global downturn with installs falling 15% and sessions declining 5% year-over-year. The U.S. market showed particularly sharp decreases with installs dropping 39% and sessions declining 23%.

Privacy and technology trends reshape marketing

App Tracking Transparency (ATT) opt-in rates in Japan climbed from 20.7% in the first half of 2024 to 21.4% in the first half of 2025, reflecting gradual improvements in user trust. Gaming applications maintained the highest opt-in rate at 31%, followed by travel at 24.3%, while finance apps showed 14.5% opt-in rates.

The report emphasizes that Japan’s relatively low ATT opt-in rates compared to global figures make consent optimization crucial for iOS-focused marketers. The broader mobile app development landscape shows record engagement levels, with users now spending an average of 5 hours daily on mobile devices globally.

Artificial intelligence integration is transforming content creation and personalization across all verticals. Gaming companies leverage AI for personalized rewards and retention optimization, while entertainment platforms use AI for dubbing, translation, and interactive storytelling features.

Technical infrastructure supports growth

Japan’s mobile infrastructure provides strong foundation for app economy growth, with 194 million mobile connections representing 157% of the population and near-universal smartphone adoption. The country’s 5G coverage across 95% of the population enables high-quality streaming and immersive app experiences.

Early engagement metrics remained robust across categories, with Japan recording 1.55 sessions per user on day 0, indicating strong initial user interest. Finance apps achieved 1.78 sessions per user on day 0, while entertainment apps averaged 1.44 sessions.

The research methodology incorporated data from multiple sources, including Adjust’s measurement platform covering approximately 250 countries and Sensor Tower’s Store Intelligence spanning 95 countries and 25 categories. The analysis utilized privacy-enhancing technologies to protect user identities while generating comprehensive market insights.

Timeline

- August 2023-June 2024: Short drama apps generate $13.22 million in revenue in Japan

- Q4 2024: Finance apps experience significant growth momentum with October showing 49% growth

- January 2025: Japan retains position as third-largest consumer app spend market at $16.5 billion

- March-April 2025: Strong start to year with installs up 8% and 6% respectively above H1 average

- May 2025: Amazon expands Brand Lift measurement tool to Japanese market

- June 2025: Netflix advertising inventory becomes available through Trade Desk platform in Japan

- July 23, 2025: Mobile App Trends 2025: Japan Edition report released

Key Terms Explained

App Tracking Transparency (ATT)

App Tracking Transparency represents Apple’s privacy framework requiring iOS apps to request user permission before tracking activities across other companies’ apps and websites. In Japan, ATT opt-in rates climbed from 20.7% to 21.4% year-over-year, with gaming apps achieving the highest consent rate at 31%. This metric has become crucial for marketers operating in Japan’s iOS-dominant environment, where securing user consent directly impacts targeting capabilities and campaign performance measurement.

Year-over-Year (YoY) Growth

Year-over-year growth serves as the primary comparative metric throughout the report, measuring percentage changes between corresponding periods in consecutive years. Finance apps demonstrated the strongest YoY performance with 50% install growth, while gaming maintained modest 3% growth. This standardized measurement approach enables meaningful comparisons across different app verticals and market conditions.

Sessions

Sessions represent individual app usage periods, measuring user engagement depth beyond simple download counts. The report tracks session growth as a key indicator of user retention and app stickiness. Finance apps achieved 22% session growth year-over-year, while gaming sessions remained stable with 0.3% growth, indicating different engagement patterns across verticals.

Installs

Installs measure new app downloads and serve as the primary user acquisition metric across all analyzed categories. The data distinguishes between organic installs driven by natural discovery and paid installs resulting from marketing campaigns. Japan’s overall app installs grew 7% year-over-year in 2024, with significant variations across verticals ranging from finance’s 50% surge to comics’ 17% decline.

iOS Platform

iOS represents Apple’s mobile operating system and constitutes a dominant force in Japan’s app economy. The platform accounts for 52% of gaming installs and 65% of sessions, while commanding 56% of finance app installs and 62% of sessions. iOS users typically demonstrate higher engagement and spending patterns, making platform optimization crucial for monetization strategies.

Gaming Apps

Gaming apps represent the traditional cornerstone of Japan’s mobile app market, maintaining consistent performance despite increased competition from other verticals. The gaming category includes subgenres ranging from puzzle and RPG titles to card and casino games. Gaming apps achieved 3% install growth year-over-year, with session lengths averaging 26.97 minutes and strong performance in titles like Pokémon TCG Pocket.

Finance Apps

Finance apps emerged as the standout growth category, encompassing banking, payment, cryptocurrency, and stock trading applications. This vertical demonstrated exceptional momentum with 50% install growth and 22% session increases year-over-year. The category benefits from Japan’s digital transformation in financial services and increasing adoption of mobile payment solutions.

Entertainment Apps

Entertainment apps experienced substantial growth with 14% year-over-year install increases, driven primarily by streaming platforms and emerging content formats. This category includes traditional video streaming services, short drama applications, and music platforms. The entertainment vertical reflects Japan’s evolving media consumption patterns and preference for mobile-first content experiences.

Short Drama Apps

Short drama apps represent an emerging entertainment subcategory featuring vertical, 1-2 minute episodes designed for mobile consumption. These applications generated $13.22 million in revenue between August 2023 and June 2024, achieving remarkable monetization efficiency with $4.13 revenue per download. The format appeals particularly to women aged 25-44 and utilizes freemium models with micro-transactions.

Revenue Per Download (RPD)

Revenue per download measures the average monetization efficiency by dividing total revenue by the number of downloads within a specific period. Short drama apps achieved $4.13 RPD, outperforming many traditional mobile games. This metric helps developers and publishers understand the financial value of their user acquisition efforts and optimize pricing strategies accordingly.

Summary

Who: Adjust and Sensor Tower, leading mobile marketing and app intelligence companies

What: Release of comprehensive Mobile App Trends 2025: Japan Edition report analyzing app performance across gaming, finance, entertainment, and comics verticals

When: July 23, 2025, covering data from January 2023 to May 2025

Where: Japan, the world’s third-largest consumer app spend market valued at $16.5 billion in 2024

Why: The report provides actionable insights for mobile marketers and developers operating in Japan’s mature but competitive app economy, where success depends on precise strategic planning and understanding of evolving user behaviors, privacy frameworks, and technology adoption patterns.