Maverick Gaming has filed for Chapter 11 bankruptcy citing competition from tribal casinos, operational misalignments, and broader industry headwinds, supported by $25.5 million in DIP financing and a prearranged restructuring agreement.

Business Description

RunItOneTime LLC (dba Maverick Gaming), along with its Debtor affiliates⁽¹⁾ (collectively, “Maverick” or the “Company”), is a privately held gaming and entertainment company specializing in the acquisition and turnaround of underperforming casino and cardroom properties.

- The Company pursues a strategy of building a portfolio of regional gaming assets and enhancing their profitability through targeted operational enhancements and marketing initiatives.

As of the Petition Date, Maverick operates a portfolio of 26 gaming properties across Washington, Nevada, and Colorado. These properties collectively feature approximately 2,500 slot machines, 320 table games, 1,200 hotel rooms, and 30 restaurants. The Company’s primary operating segments include:

- Washington Card Rooms: Maverick is one of the largest cardroom operators in Washington, with 17 active house-banked cardrooms concentrated in the Seattle area.

- Nevada Casino Hotels: The Company owns five properties in rural Nevada markets, including the Wendover Nugget and Red Garter casinos in West Wendover and three properties in Elko. These locations offer a full suite of gaming options, lodging, and other amenities.

- Colorado Casinos: Maverick operates three casinos in the historic mining towns of Black Hawk and Central City. These smaller-scale casinos primarily cater to day-trip gamblers from Denver.

- EGads! LLC: Acquired in 2020, the Las Vegas-based subsidiary designs custom casino interiors, signage, and themed décor. The unit has become one of the Company’s more profitable segments, with revenue climbing to $33.2 million in 2024 from $22.1 million in 2022. EBITDA more than doubled over that period to $10.6 million.

- Utah Trailways: To drive traffic to its Wendover, NV, casinos, Maverick operates a charter bus service that transports customers from the Salt Lake City area, a crucial link to its Utah customer base.

RunItOneTime LLC and its affiliates filed for Chapter 11 protection on July 14, 2025 (the “Petition Date”), in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $100 million to $500 million in both assets and liabilities.

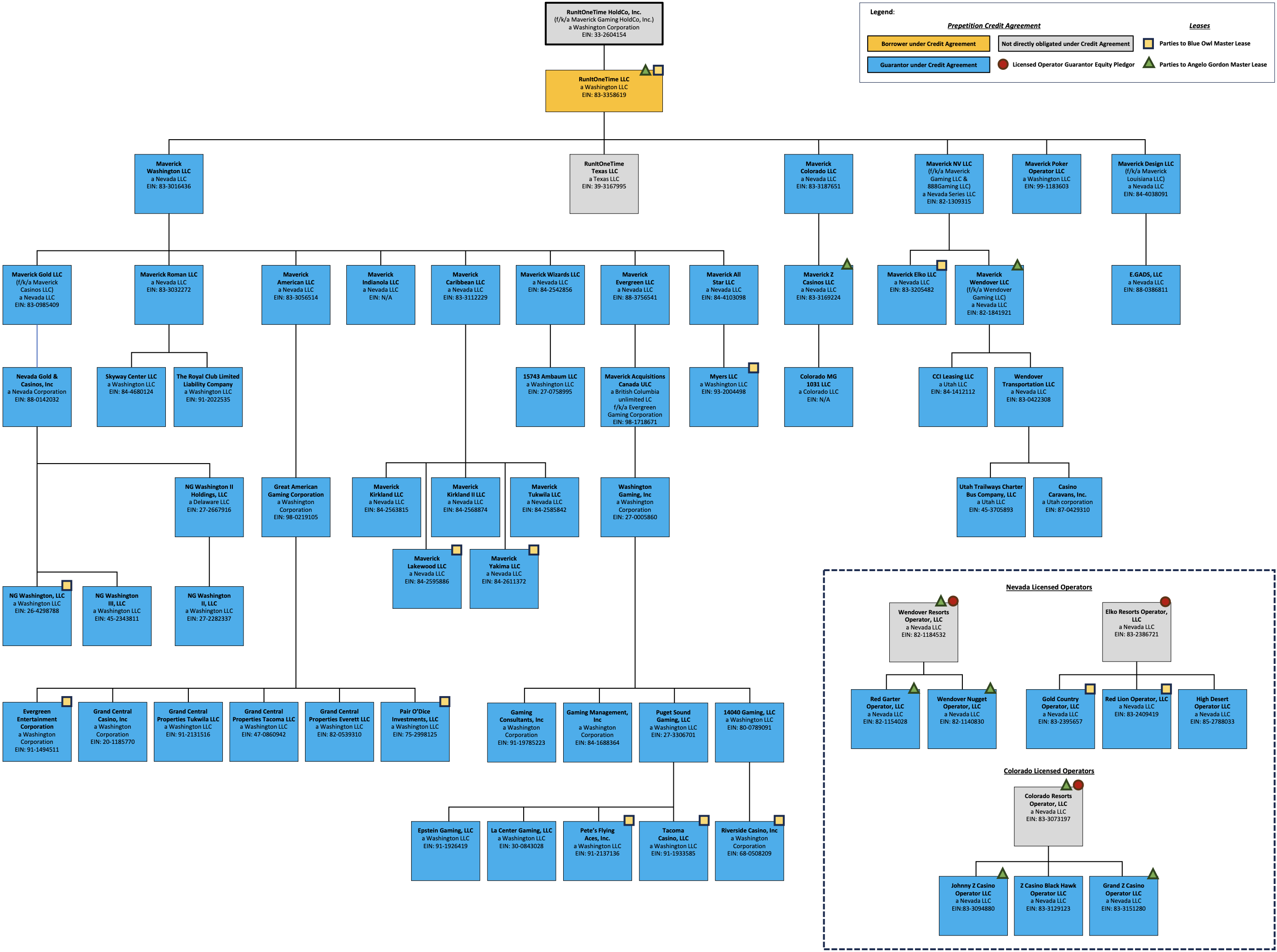

⁽¹⁾ For a complete list of Debtor entities, see the organizational structure chart below.

Corporate History

Maverick Gaming was founded in 2017 by CEO Eric Persson and COO Justin Beltram, gaming industry veterans with over 30 years of combined experience at Las Vegas Sands, Bellagio, and Marina Bay Sands.

- The Company remains privately held, with Persson controlling roughly 58% through parent entity RunItOneTime HoldCo Inc. Beltram holds about 13%, while the remainder is split among other stakeholders.

- Persson’s majority ownership and hands-on leadership as CEO have centralized decision-making, raising governance concerns such as key-person risk and the absence of an independent board, as noted by credit analysts.

Acquisition-Driven Expansion

- 2018–2019: Maverick rapidly entered the Washington and Nevada markets. A key transaction was the 2019 acquisition of then-publicly traded Nevada Gold & Casinos, Inc., which gave Maverick a major foothold with nine cardrooms in Washington. During this period, the Company also acquired its Wendover and Elko, NV, casino portfolios.

- 2019–2020: The Company expanded into Colorado by purchasing three casinos in Black Hawk and Central City. An announced $230 million deal to acquire the Eldorado Shreveport casino in Louisiana was ultimately terminated in mid-2020 due to the COVID-19 pandemic and financing challenges.

- 2020: Maverick diversified its operations by acquiring EGads! LLC, a casino design and fabrication business. This strategic move was intended to vertically integrate branding and renovation capabilities for its growing portfolio.

- 2021–2022: The Company solidified its presence in Washington by acquiring Evergreen Gaming Corp. for approximately $80 million, adding four more cardrooms to its portfolio.

Corporate Organizational Structure

- To comply with varying state gaming laws, Maverick adopted a complex OpCo/PropCo structure. Real estate and facilities are owned or leased by operating subsidiaries (PropCo entities, among the Maverick Debtors), while gaming licenses and operations are held by separate affiliates (OpCo entities) wholly owned by Persson.

- This structure streamlines the licensing process by limiting the number of individuals and entities subject to regulatory suitability reviews. However, it also creates a complex web of interrelated entities, with both PropCo and OpCo affiliates filing as co-Debtors in the jointly administered Chapter 11 cases.

Operations Overview

As of the Petition Date, Maverick maintained operations across three states, with a portfolio consisting of 26 active properties and nine non-operating sites that were previously closed to consolidate gaming revenue. The Company employs approximately 2,900 individuals across its operations.

Washington Card Rooms

The 17 active Washington card rooms are compact venues, typically 5,000–15,000 square feet, offering up to 15 tables each with house-banked games like blackjack and baccarat, player-supported poker, and other card variants, alongside bars and dining options such as grills or Asian cuisine. These neighborhood casinos primarily serve local patrons in the Seattle-Tacoma area and other communities, without slots or electronic gaming restricted to tribal casinos.

Nevada Casino Hotels

The Nevada portfolio includes four hotel-casinos catering to drive-in traffic from Utah and eastern Nevada. The Wendover Nugget and Red Garter properties, located near the Utah border, offer full-service gaming with hotels and on-site sportsbooks. In Elko, the Maverick Hotel & Casino and Gold Country Inn & Casino serve both local patrons and I-80 travelers.

Colorado Casinos

The three casinos in Central City and Black Hawk are modest due to the small-town market. Grand Z Casino & Hotel, the largest, includes 576 slots, 8 table games, and 118 hotel rooms. Dragon Tiger and Z Casino focus on slots without lodging. A gas station/truck stop supports the area.

Sale-Leaseback Financing

To generate capital, Maverick executed sale-leasebacks, introducing fixed rents akin to debt:

- In 2021, land under several Nevada and Colorado casinos was sold to Angelo Gordon affiliates for $93 million, leased back at $8.5 million annually.

- In 2022–2023, multiple Washington and Nevada properties were sold to Blue Owl affiliates for $205 million, leased back at $17.8 million annually. Rent payments to Blue Owl ceased after April 2025, accruing $5.9 million in arrears by filing.

These transactions triggered $26 million in capital gains taxes for 2022–2023, exacerbating liquidity issues amid tightening cash flow.

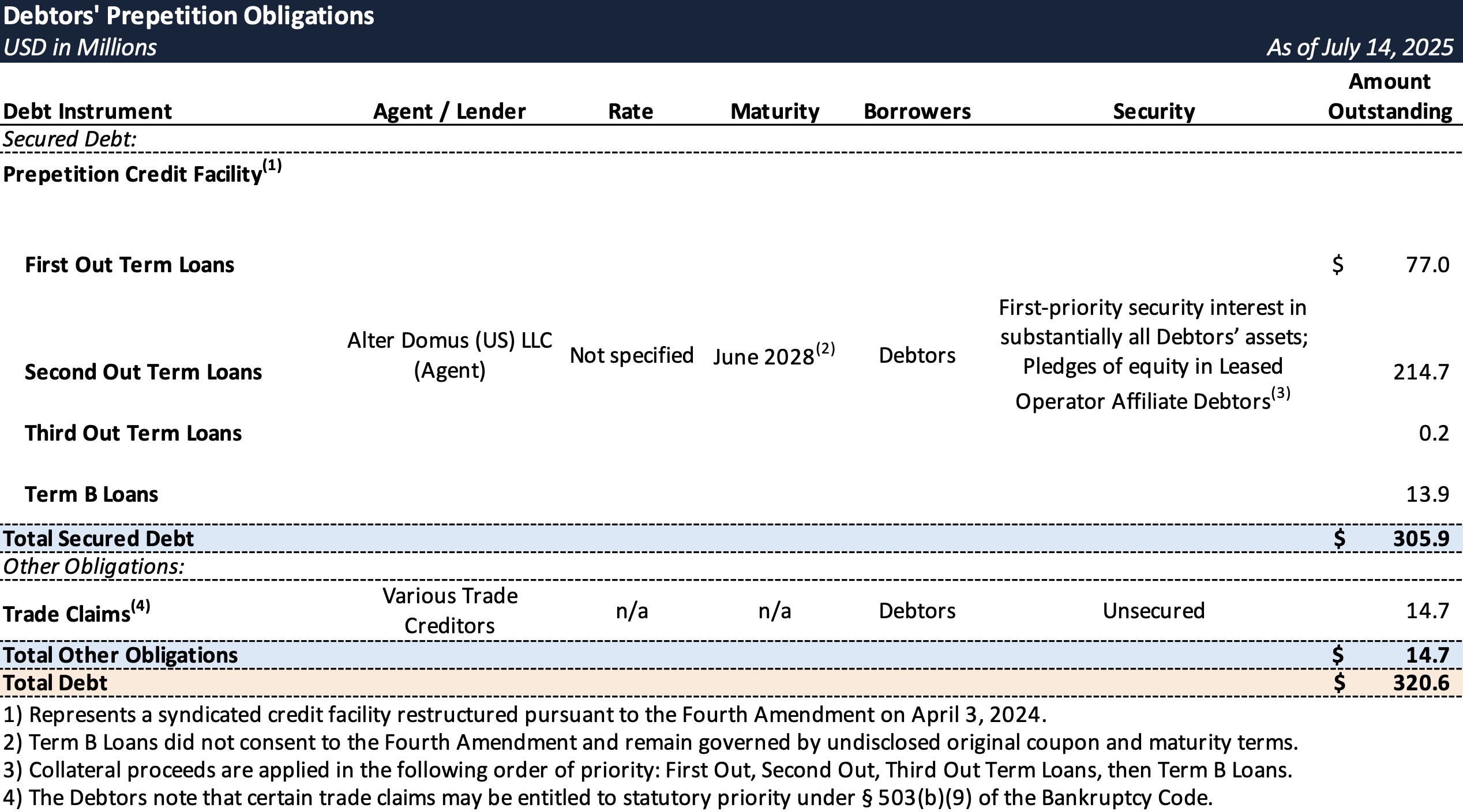

Prepetition Obligations

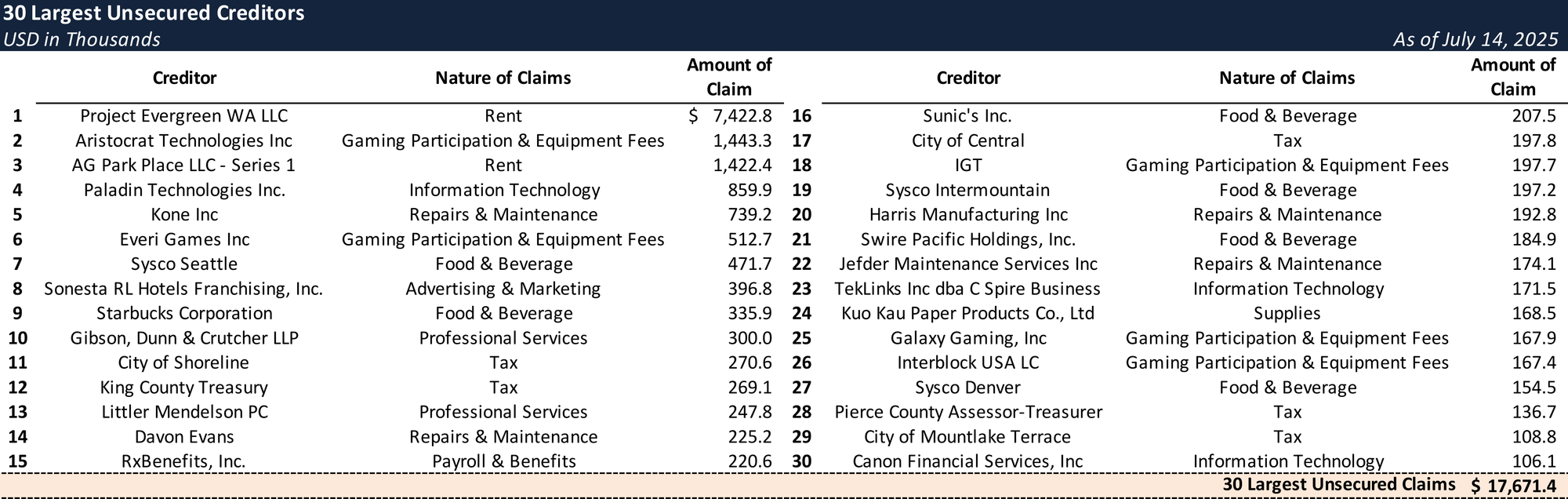

Top Unsecured Claims