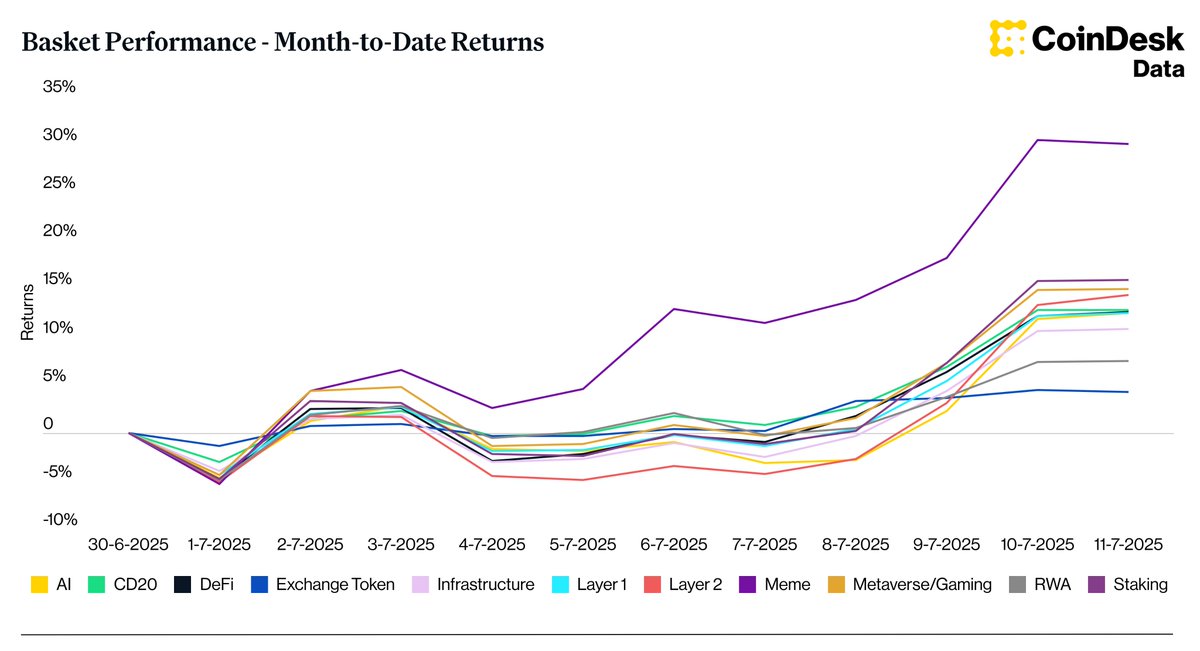

Meme coins are dominating the crypto market in July, outperforming all other sectors with a staggering 30.06% return so far this month, according to the latest data from CoinDesk.

The basket performance chart highlights strong momentum in community-driven tokens, far ahead of other narratives.

Staking, gaming, and Layer 2 also surge

Following meme coins, staking tokens have returned 15.83% month-to-date, reflecting growing interest in passive yield strategies. Metaverse and gaming assets are close behind at 14.93%, showing renewed investor appetite in virtual ecosystems.

Layer 2 solutions also delivered a solid 14.37% gain, suggesting confidence in scalable blockchain alternatives. Layer 1s performed slightly below with 12.45%, still a notable rebound amid recent market strength.

Other strong performers include DeFi (12.57%), the CoinDesk 20 index (12.75%), and infrastructure-related tokens (10.80%).

AI suffers sharp decline

In contrast, the AI category is the biggest underperformer with a -12.40% return. Despite previous hype around artificial intelligence integrations, the sector has failed to maintain upward momentum in July.

Exchange tokens posted a modest 4.21% gain, while real-world asset (RWA) tokens climbed 7.43%, continuing their steady ascent in recent months.

The chart, which covers performance from June 30 to July 11, shows a clear divergence in market sentiment—where meme-driven tokens and staking strategies are currently leading the charge.

Kosta has been working in the crypto industry for over 4 years. He strives to present different perspectives on a given topic and enjoys the sector for its transparency and dynamism. In his work, he focuses on balanced coverage of events and developments in the crypto space, providing information to his readers from a neutral perspective.