Reports of the week:

-

Wall Street Journal: Young Americans’ Spending on Games Drops Nearly 25% YoY

-

Aream & Co.: Gaming Investment Market in Q2’25

-

Circana: The U.S. Gaming Market in May 2025

-

GameDiscoverCo: Top 10 Steam Games in June 2025

-

Alinea Analytics: Top PlayStation Games in June 2025 by copies sold

The Wall Street Journal published a piece featuring a study on the economic behavior of young people aged 18 to 24 in the US. The data used was from Circana, covering spending from January to April 2025.

-

Games are the hardest-hit category among young Americans as of April 2025. Their spending dropped nearly 25% YoY, while other age groups saw a decline of just a few percent.

-

The authors attribute the issue to a combination of factors: challenges in the labor market, tightening of student loans, and credit card debt. Overall, young people are cutting back on spending for entertainment, accessories, and clothing.

-

According to Bank of America, spending in this age group has historically risen. The current decline is atypical and signals structural problems in the economy.

-

An additional negative factor is the introduction of tariffs, which could impact game and console prices in the US and the general rise in game prices.

-

Mobile market IAP revenue has stabilized at around $20 billion per quarter.

-

This is happening against the backdrop of declining downloads. The situation is concerning as new user inflow is dropping, so competition for existing users intensifies.

-

Century Games, Supercell, and iKame are leaders in incremental IAP revenue growth (after the 30% commission) in the US market.

-

The PC market looks more positive. Steam revenue in Q2’25 grew 20% year-over-year. CCU (concurrent users) on the platform is hitting new records.

-

Over the last 5 years, the average annual growth rate for F2P games was 17%; for premium projects, 13%. Peak CCU is growing at 11% per year.

-

Among key new releases in Q2’25: two new IPs (Clair Obscur: Expedition 33 and Rematch), both launched in partnership with Kepler Interactive.

-

The console market remains cyclical and heavily dependent on new hardware and major releases.

-

For the 2024 fiscal year, Xbox gaming revenue grew by 5%. In the same period, Sony reported 9% growth and 77 million PlayStation 5 units sold. Nintendo, however, saw a 30% drop in revenue, reporting just before the launch of Nintendo Switch 2.

-

CCU in Fortnite and Roblox continues to climb.

-

The situation on Twitch is mixed: the number of games streamed is rising (good), but users are spending less time watching content (bad).

-

All UGC platforms are increasing payouts to creators. In 2024, Roblox paid out 25% more than in 2023 ($923M vs. $741M). Epic Games increased payouts by 11% ($352M vs. $317M). Overwolf raised payouts by 19% ($240M vs. $201M).

-

In total, $1.5 billion was paid out in 2024, 20% more than in 2023.

-

Alongside the growth in payouts, investments related to UGC studios are also rising.

Aream & Co. prepared the investment market analysis in collaboration with InvestGame.

-

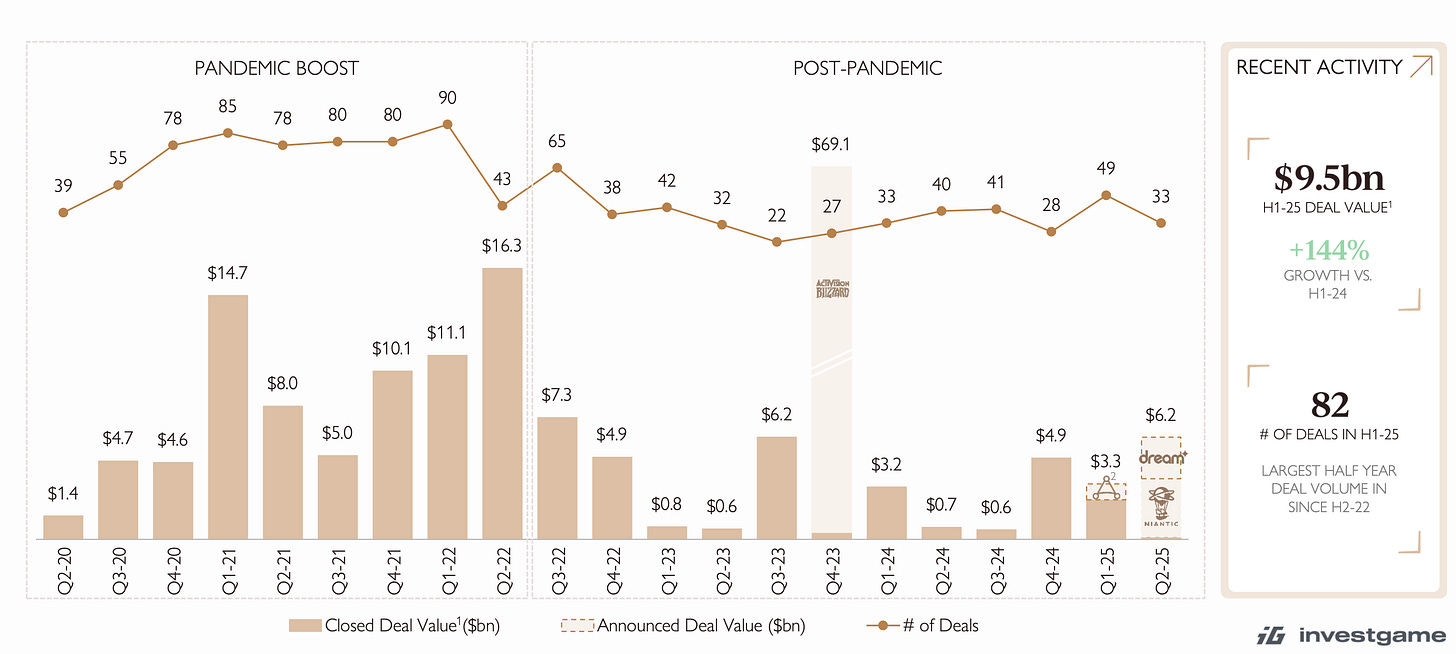

The first half of 2025 was the best since the end of the pandemic in terms of deal volume ($9.5B, up 144% vs. the previous half-year) and number of deals (82 deals—a record since H2’22).

❗️The Activision Blizzard/Microsoft deal is excluded. The Dream Games deal is expected to close in Q3’25.

-

All recent major deals are in the mobile segment, with the exception of the Keywords Studios deal.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Since 2018, private companies and funds have made 68 deals totaling $22B (InvestGame estimates). Since 2024, there have been 6 major deals: Niantic Games, Keywords Studios, Jagex, Liftoff, Dream Games, and Aonic.

-

M&A activity has recovered post-COVID. Since H1 2024, activity continues to grow, the market is consolidating rapidly.

❗️However, if you exclude Keywords Studios (not a developer or publisher), there is no clear upward trend.

-

Public market activity reached a four-year high in H1 2025: 26 deals (+24% YoY) totaling $10B (+134% YoY).

-

Companies are actively using financial instruments—convertible bonds, additional share issues, PIPE investments, flexible credit lines.

-

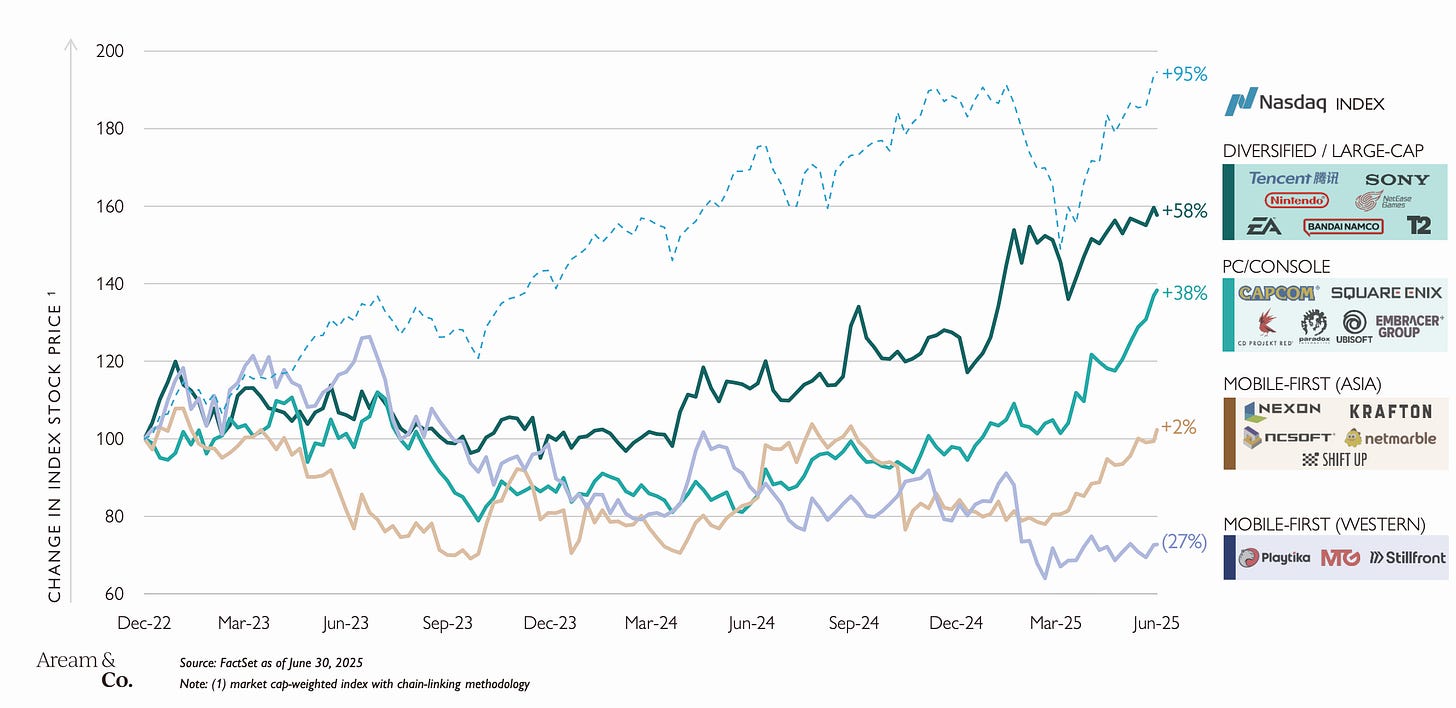

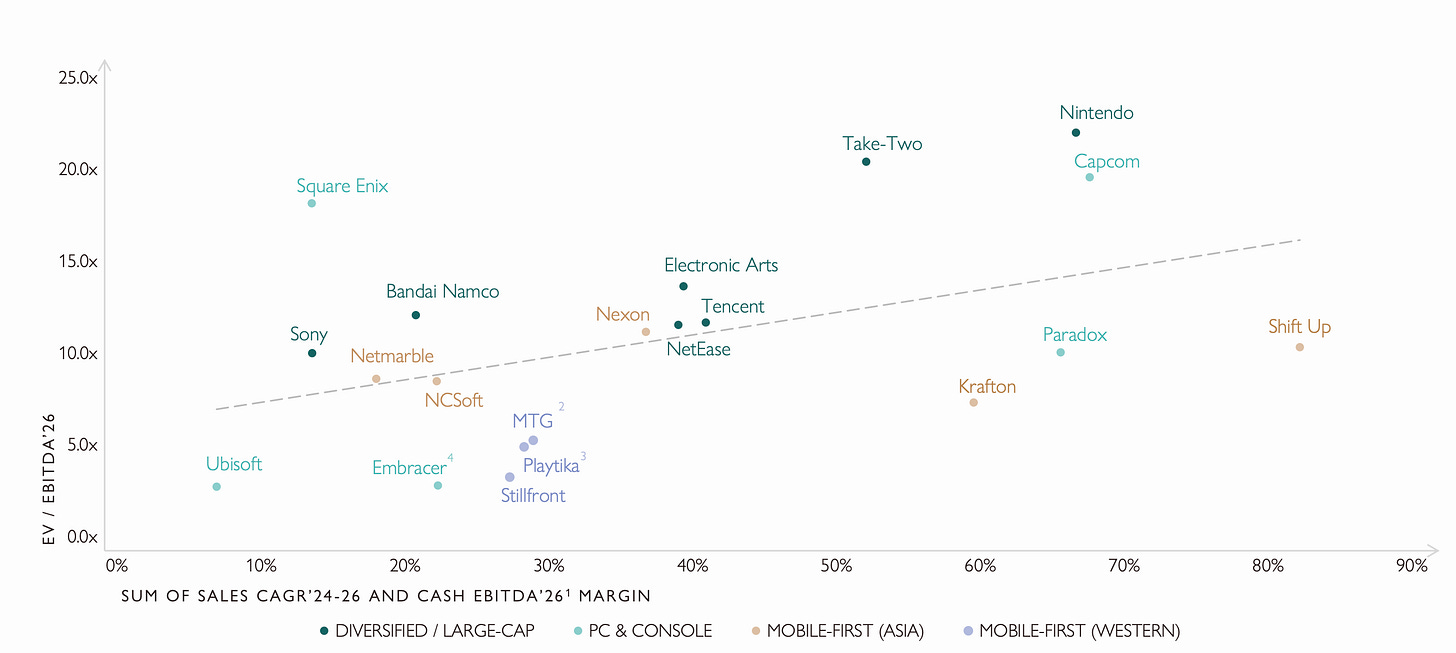

The stock index for major diversified holdings (Tencent, Sony, Nintendo, Electronic Arts) grew 58% YoY in Q2’25. PC/console developers (Capcom, Square Enix, CDPR, Paradox Interactive) saw a 38% YoY increase.

-

Mobile developer stocks are not doing as well. Asian companies (Nexon, Krafton, NCSoft, Netmarble) grew 2%. Western developers (Playtika, MTG, Stillfront) fell 27% YoY.

-

EBITDA multiples for PC/console developers are at historic highs – 18x. Major holdings are at 15.4x. Mobile developers are at historic lows: Asian companies trade at 10.6x EBITDA; Western at 5x.

-

Investor sentiment toward the gaming market has recovered. Most gaming stocks are at 52-week highs.

-

Interestingly, despite high valuations and multiples, most PC/console companies did not show revenue growth in Q1’25. Mobile companies, on the contrary, did.

-

Nintendo, Capcom, and Take-Two are likely to be the most attractive stocks by the end of 2026.

-

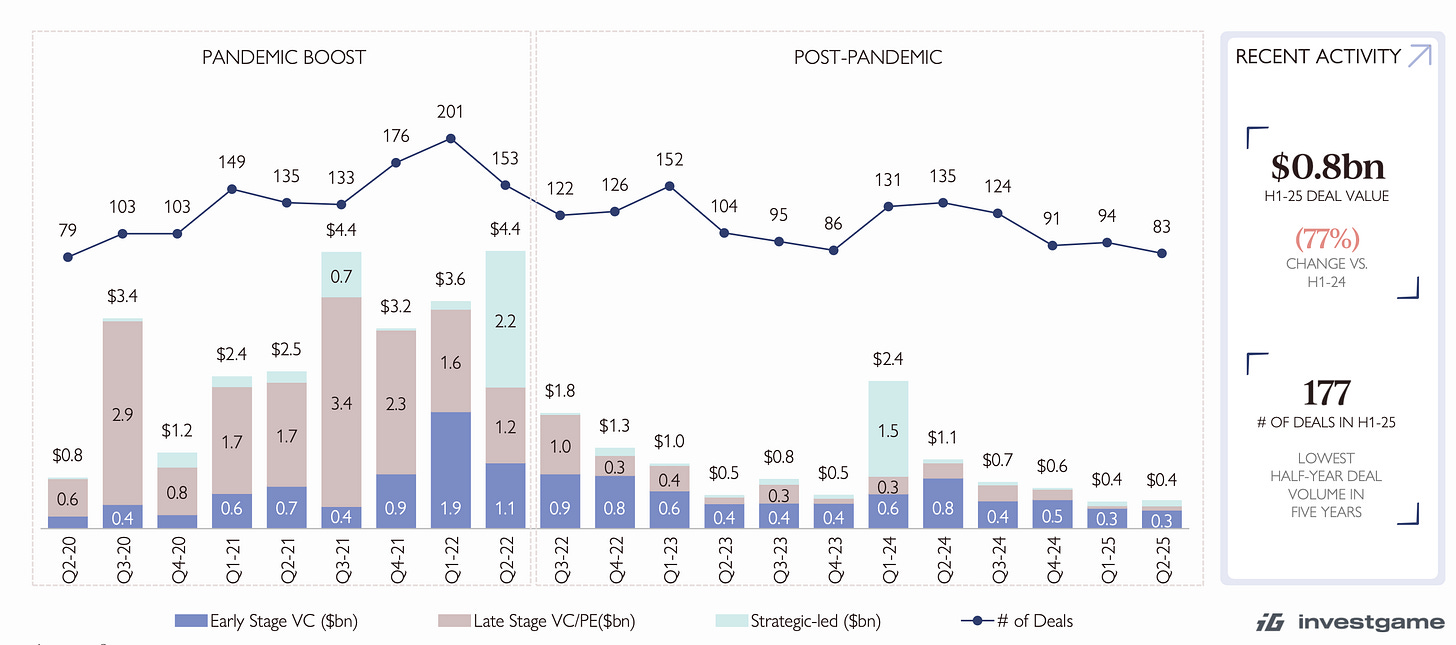

VC activity in H1’25 reached a five-year low. Total volume: $0.8B (-77% YoY) across 177 deals (lowest in 5 years).

-

Early-stage deal count (excluding Web3 and esports) continues to fall. In H1’25, there were 85 pre-seed/seed deals totaling $0.4B. Series A volume: $0.2B across 18 deals.

-

The investment climate for early-stage companies is the worst in 5 years.

-

The largest Q2’25 content producer deals: Bigger ($25M, Series A), HYBE ($21M, Series B+), Amplitude Studios ($13.6M, Series A).

-

Among platforms and tech solutions, leaders are Sett ($15M, Series A—AI creative production), eloelo ($13.5M, Series B—India-focused creator platform), and spAItial ($13M, seed—UGC platform).

-

Since 2020, over $2B has been invested in AI gaming startups, with 283 deals known.

-

Türkiye has become a key region for VC investments. Since 2020, there have been 113 early-stage deals totaling $0.8B. In the last 1.5 years, there were 28 deals—more than in any other country.

-

Another trend: Aream & Co. notes that companies are actively using external capital for UA.

-

A16Z Games (20), Bitkraft (19), and Laton Ventures (11) are the most active investors by deal count over the last 12 months.

-

Bitkraft ($123M), A16Z Games ($107M), and Play Ventures ($98M) are the leaders by invested capital.

-

In May, the U.S. video game market generated $4.052 billion, 1% higher than last year.

-

Game sales increased by 2%, from $3.664 billion in May 2024 to $3.726 billion in May 2025. Most of the growth came from non-mobile subscriptions, which grew 29% YoY.

-

Hardware sales dropped 13% YoY, from $197 million to $172 million. Nintendo Switch 2 had not yet launched this month.

-

Original Nintendo Switch sales fell 44% YoY; PS5 sales rose 3%. Xbox Series S|X sales declined 30%.

-

PlayStation 5 remains the clear leader in both unit and dollar sales.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Accessory sales dropped 6%, from $165 million to $154 million. DualSense is the best-selling accessory.

-

U.S. gamers spent $0.6 billion on subscriptions in May 2025, an all-time high. Subscriptions have been growing for three consecutive months. Mat Piscatella suggests this may be tied to rising prices in the U.S. and users wanting more value for their money.

-

Elden Ring: Nightreign and DOOM: The Dark Ages were the top games in May by dollar sales.

-

Other new releases include F1 25 (ranked 15th) and Capcom Fighting Collection 2 (ranked 19th).

-

Star Wars: Battlefront II jumped from 135th place in April to 12th in May. The game was heavily discounted; on PC alone, it ranked 5th.

-

Monster Hunter: Wilds remains the best-selling game of the year in the U.S. so far. The Elder Scrolls IV: Oblivion Remastered moved up one spot.

-

Elden Ring: Nightreign and DOOM: The Dark Ages entered the charts immediately.

-

The top-grossing mobile games remain MONOPOLY GO!, Royal Match, and Last War: Survival.

-

Evony entered the top 10, with its May revenue up 20% according to Sensor Tower.

-

PlayStation and Xbox sales charts are very similar. Notably, DOOM: The Dark Ages made the Xbox top 3, even though it’s available on Game Pass.

-

Nintendo charts remain stable, with Capcom Fighting Collection 2 performing well.

-

Circana now shares PC charts (for premium titles). Helldivers 2 sold very well in May after updates. Overall, Sony had a strong month on PC platforms, with three games in the top ranks.

❗️Circana’s PC sales data includes Battle.net, Bethesda.net, EA App, EGS, Rockstar Store, Steam, Ubisoft Store, and Microsoft Store.

-

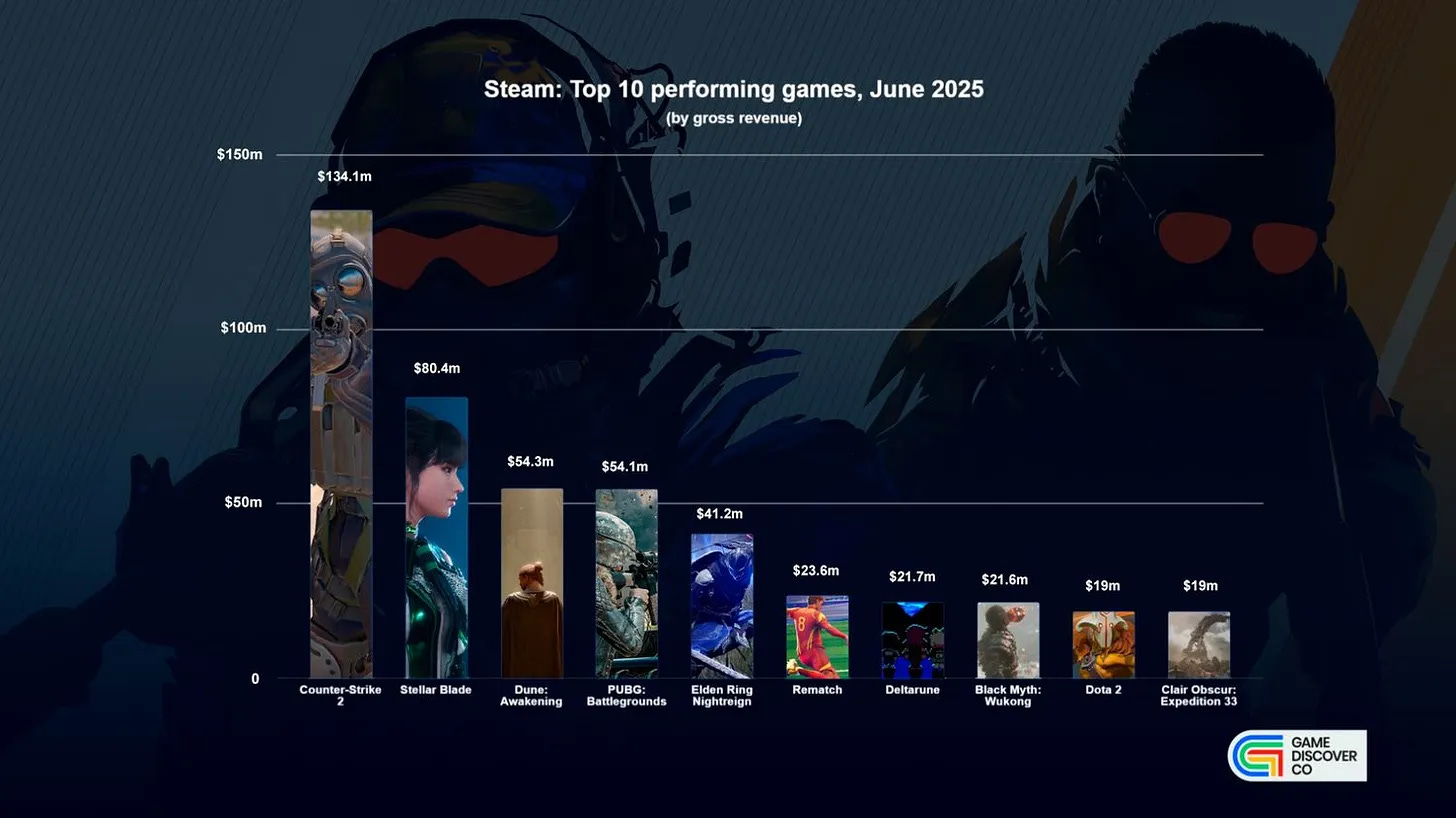

Stellar Blade is the top-grossing new release. The game earned $80.4M in gross revenue in June. 58% of its audience is from China.

-

Second place goes to Dune: Awakening with $54.3M in gross revenue. Third and fourth are Rematch ($23.6M) and Deltarune ($21.7M).

-

Broken Arrow is the unexpected success of the month. The game made $12.1M, with CCU around 20,000, and is sold at $49.99.

-

Another unusual entry on the list is Date Everything! This is a dating simulator where you can date… household objects. The game earned $4.4M.

-

In terms of copies sold, Peak is June’s leader. The game sold 2.9 million copies in two weeks.

-

There’s a strong overlap with the gross revenue chart above, which means there are few cheap projects (except for Peak).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Interestingly, the chart for copies sold includes two Chinese FMV games: Revenge on Gold Diggers (1.1 million copies) and God Bless, or Goddess (180,000 copies).

-

The leader by a wide margin in total gross revenue is Counter-Strike 2. According to GameDiscoverCo, the game earned about $134M in June.

❗️Simon Carless (Founder of GameDiscoverCo) notes that estimating F2P project revenue is more complicated than B2P. There may be inaccuracies.

-

Notably, Stellar Blade did not heavily discount the game in China (a standard market practice). The game is 37.5% cheaper than in the US, but 35% more expensive than Steam’s recommended price. Usually, the Chinese audience reacts sharply to this, but this time it was fine.

-

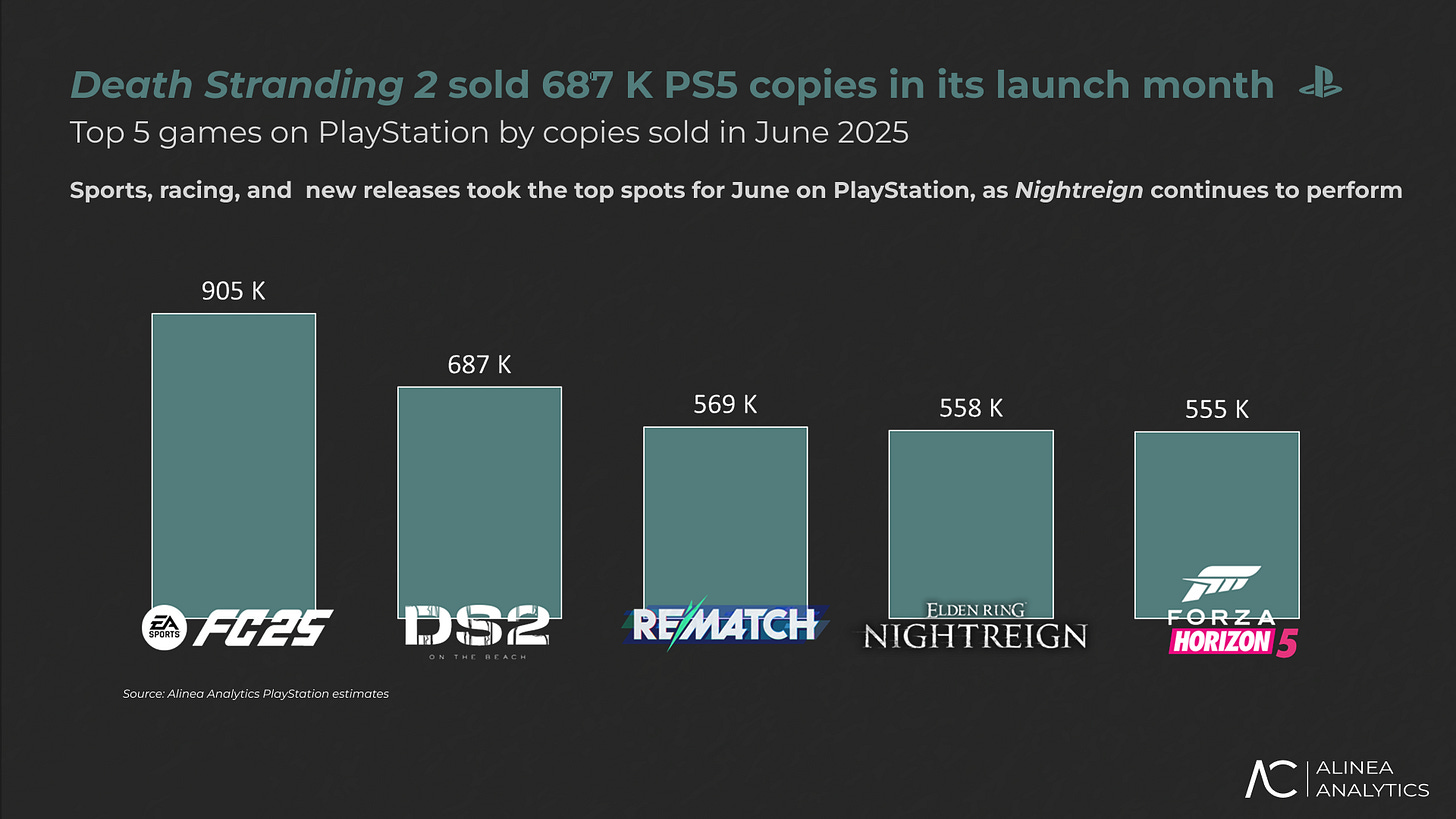

EA Sports FC 25 leads in copies sold: 905,000 units in June. This is a record since March, driven by a major discount to $13.99. The total number of PlayStation owners for the game reached 19.2 million. Notably, 59% of EA FC 24 owners still haven’t purchased the new installment.

-

In its first week after release, Death Stranding 2 reached 687,000 copies sold (over 850,000 by July 9). A third of owners played more than 20 hours (and 4% played over 50 hours). Despite high critic and user scores, sales are relatively modest. China is the project’s second-largest market after the US.

-

Rematch had a strong start, selling 569,000 copies. 88% of buyers also played Rocket League; 61% own EA Sports FC 25; and 23% also played Sifu.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Elden Ring: Nightreign continues to show solid sales—558,000 copies in June.

-

Forza Horizon 5 remains in the top 5, with 555,000 copies sold in June. Cumulative PlayStation sales reached 2.9 million, making it the first Xbox game to hit such a figure. It sold more copies than Astro Bot.

-

In sixth place is GTA V (431,000 copies). The game remains in the charts twelve years after release, a true phenomenon.

-

Minecraft sold 416,000 copies in June.

-

Stellar Blade, following its PC launch, sold 241,000 copies. Users responded to PC version marketing, and sales jumped 4x compared to typical discounts.

-

Clair Obscur: Expedition 33 is in 9th place with 240,000 copies. According to Alinea Analytics, total PlayStation sales reached 1.3 million, and 2.2 million on Steam. The game is selling faster than major JRPGs from established franchises.

-

The chart is closed by The Last of Us: Part II with 150,000 copies sold.