-

Mobile market IAP revenue has stabilized at around $20 billion per quarter.

-

This is happening against the backdrop of declining downloads. The situation is concerning as new user inflow is dropping, so competition for existing users intensifies.

-

Century Games, Supercell, and iKame are leaders in incremental IAP revenue growth (after the 30% commission) in the US market.

-

The PC market looks more positive. Steam revenue in Q2’25 grew 20% year-over-year. CCU (concurrent users) on the platform is hitting new records.

-

Over the last 5 years, the average annual growth rate for F2P games was 17%; for premium projects, 13%. Peak CCU is growing at 11% per year.

-

Among key new releases in Q2’25: two new IPs (Clair Obscur: Expedition 33 and Rematch), both launched in partnership with Kepler Interactive.

-

The console market remains cyclical and heavily dependent on new hardware and major releases.

-

For the 2024 fiscal year, Xbox gaming revenue grew by 5%. In the same period, Sony reported 9% growth and 77 million PlayStation 5 units sold. Nintendo, however, saw a 30% drop in revenue, reporting just before the launch of Nintendo Switch 2.

-

CCU in Fortnite and Roblox continues to climb.

-

The situation on Twitch is mixed: the number of games streamed is rising (good), but users are spending less time watching content (bad).

-

All UGC platforms are increasing payouts to creators. In 2024, Roblox paid out 25% more than in 2023 ($923M vs. $741M). Epic Games increased payouts by 11% ($352M vs. $317M). Overwolf raised payouts by 19% ($240M vs. $201M).

-

In total, $1.5 billion was paid out in 2024, 20% more than in 2023.

-

Alongside the growth in payouts, investments related to UGC studios are also rising.

Aream & Co. prepared the investment market analysis in collaboration with InvestGame.

-

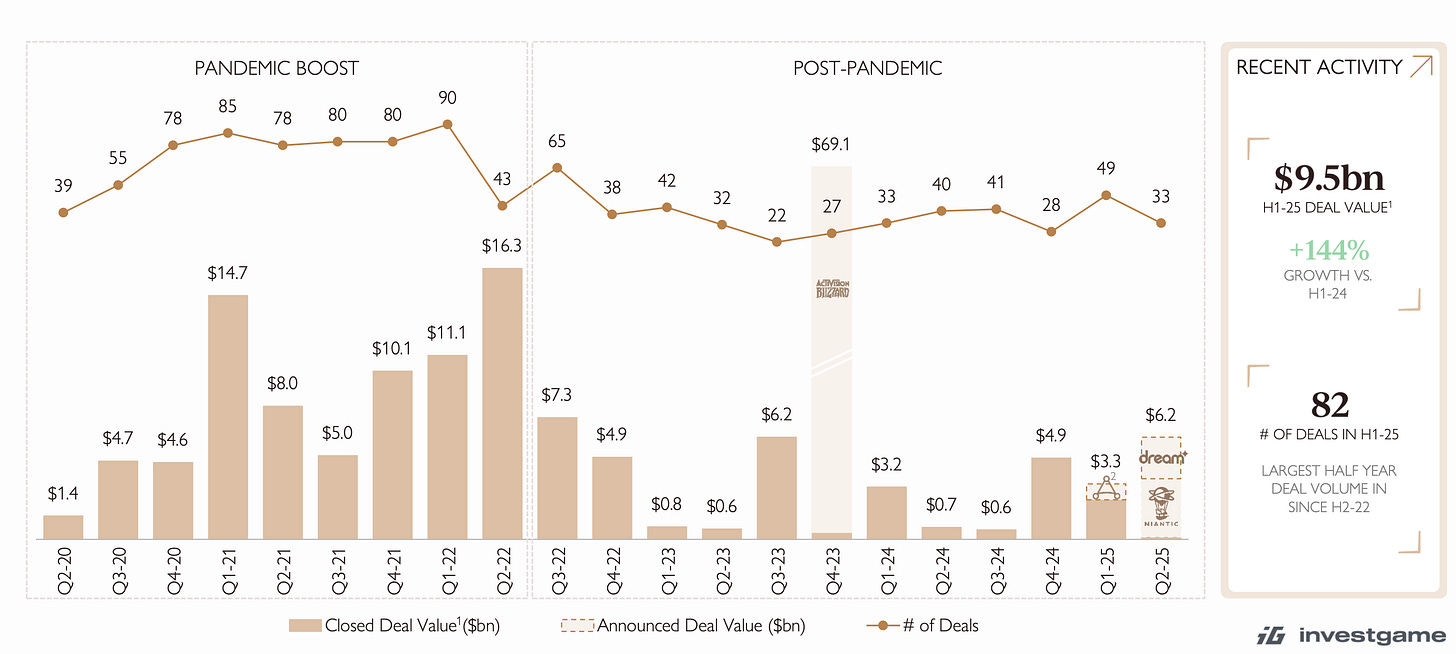

The first half of 2025 was the best since the end of the pandemic in terms of deal volume ($9.5B, up 144% vs. the previous half-year) and number of deals (82 deals—a record since H2’22).

❗️The Activision Blizzard/Microsoft deal is excluded. The Dream Games deal is expected to close in Q3’25.

-

All recent major deals are in the mobile segment, with the exception of the Keywords Studios deal.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Since 2018, private companies and funds have made 68 deals totaling $22B (InvestGame estimates). Since 2024, there have been 6 major deals: Niantic Games, Keywords Studios, Jagex, Liftoff, Dream Games, and Aonic.

-

M&A activity has recovered post-COVID. Since H1 2024, activity continues to grow, the market is consolidating rapidly.

❗️However, if you exclude Keywords Studios (not a developer or publisher), there is no clear upward trend.

-

Public market activity reached a four-year high in H1 2025: 26 deals (+24% YoY) totaling $10B (+134% YoY).

-

Companies are actively using financial instruments—convertible bonds, additional share issues, PIPE investments, flexible credit lines.

-

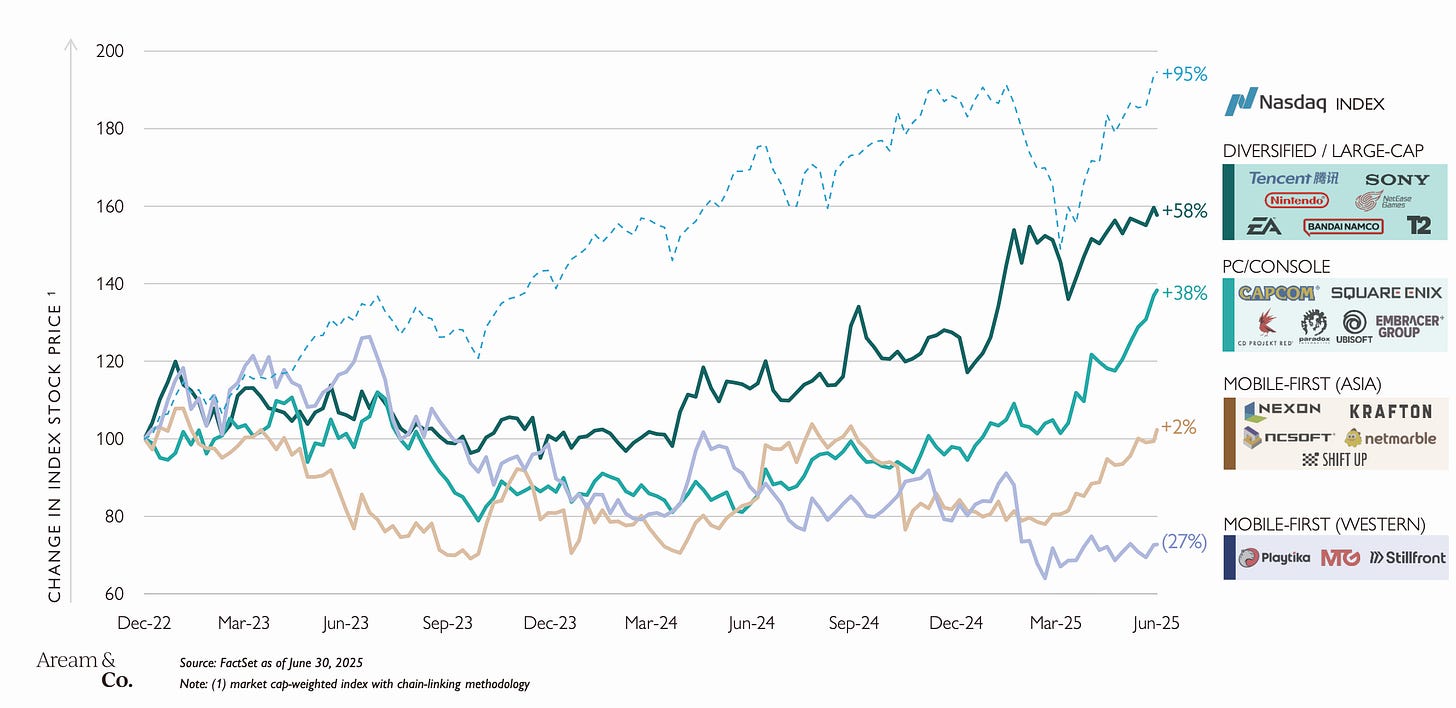

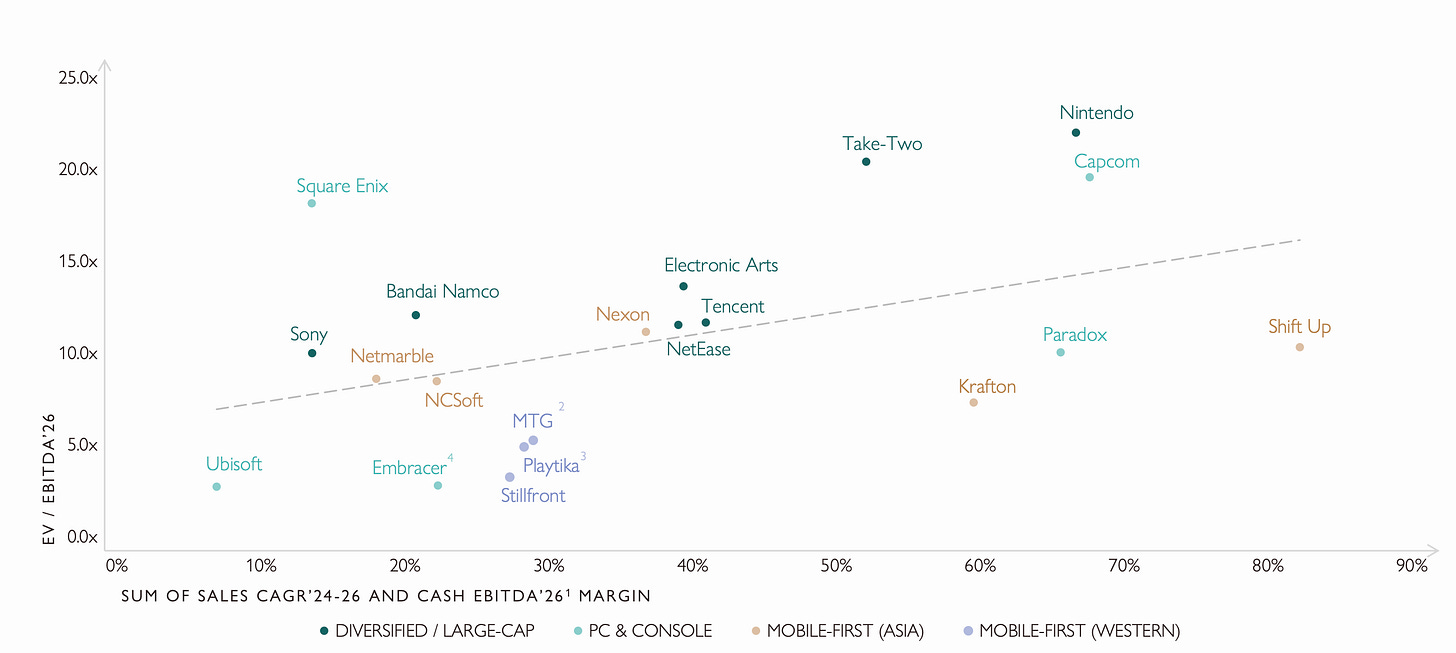

The stock index for major diversified holdings (Tencent, Sony, Nintendo, Electronic Arts) grew 58% YoY in Q2’25. PC/console developers (Capcom, Square Enix, CDPR, Paradox Interactive) saw a 38% YoY increase.

-

Mobile developer stocks are not doing as well. Asian companies (Nexon, Krafton, NCSoft, Netmarble) grew 2%. Western developers (Playtika, MTG, Stillfront) fell 27% YoY.

-

EBITDA multiples for PC/console developers are at historic highs – 18x. Major holdings are at 15.4x. Mobile developers are at historic lows: Asian companies trade at 10.6x EBITDA; Western at 5x.

-

Investor sentiment toward the gaming market has recovered. Most gaming stocks are at 52-week highs.

-

Interestingly, despite high valuations and multiples, most PC/console companies did not show revenue growth in Q1’25. Mobile companies, on the contrary, did.

-

Nintendo, Capcom, and Take-Two are likely to be the most attractive stocks by the end of 2026.

-

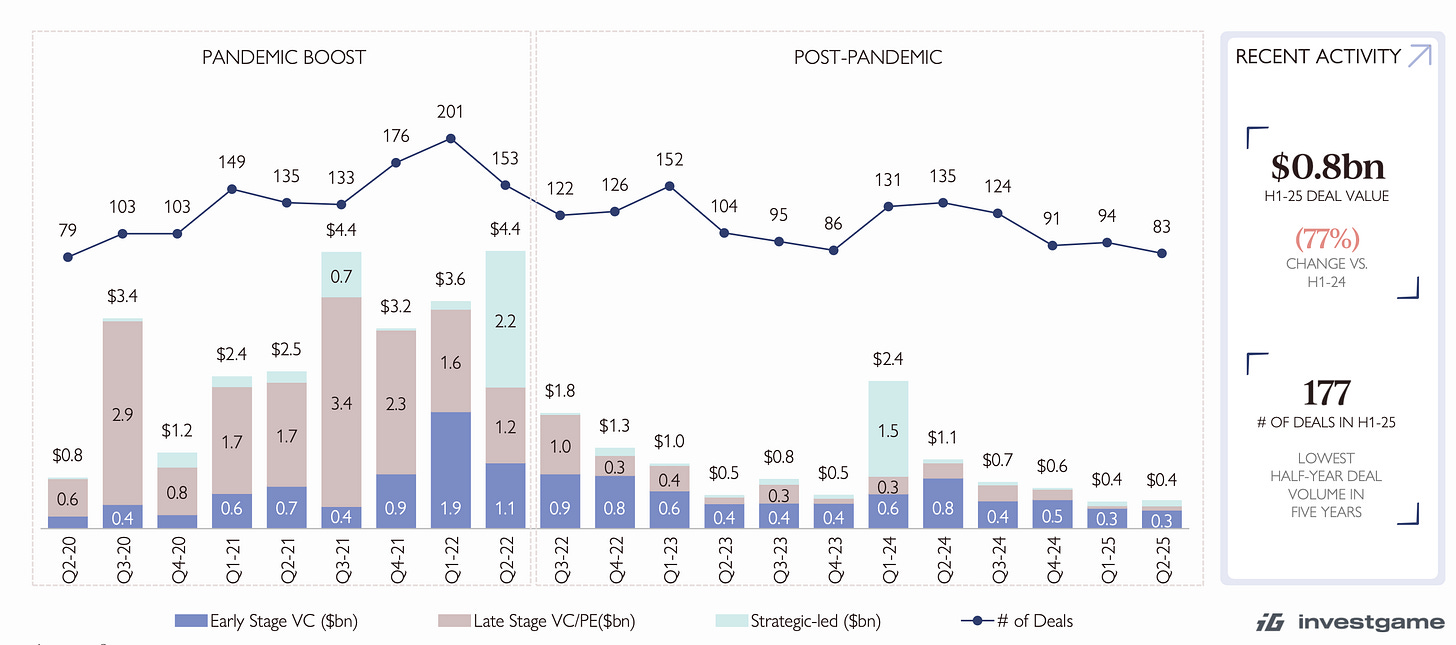

VC activity in H1’25 reached a five-year low. Total volume: $0.8B (-77% YoY) across 177 deals (lowest in 5 years).

-

Early-stage deal count (excluding Web3 and esports) continues to fall. In H1’25, there were 85 pre-seed/seed deals totaling $0.4B. Series A volume: $0.2B across 18 deals.

-

The investment climate for early-stage companies is the worst in 5 years.

-

The largest Q2’25 content producer deals: Bigger ($25M, Series A), HYBE ($21M, Series B+), Amplitude Studios ($13.6M, Series A).

-

Among platforms and tech solutions, leaders are Sett ($15M, Series A—AI creative production), eloelo ($13.5M, Series B—India-focused creator platform), and spAItial ($13M, seed—UGC platform).

-

Since 2020, over $2B has been invested in AI gaming startups, with 283 deals known.

-

Türkiye has become a key region for VC investments. Since 2020, there have been 113 early-stage deals totaling $0.8B. In the last 1.5 years, there were 28 deals—more than in any other country.

-

Another trend: Aream & Co. notes that companies are actively using external capital for UA.

-

A16Z Games (20), Bitkraft (19), and Laton Ventures (11) are the most active investors by deal count over the last 12 months.

-

Bitkraft ($123M), A16Z Games ($107M), and Play Ventures ($98M) are the leaders by invested capital.