Reports of the week:

-

Sensor Tower: India Mobile Games Market in 2025

-

Games & Numbers (June 18 – July 1, 2025)

-

AppMagic: Top Mobile Games by Revenue and Downloads in June 2025

-

Stream Hatchet: Indie Games on Streaming Platforms

-

Newzoo: Audience Reaction to IP in Games

-

Alinea Analytics: Top Steam games by copies sold in June 2025

-

India is the largest market in Asia (and globally) by downloads. From April 2024 to March 2025, there were 8.45 billion game downloads (-8.7% YoY). That’s more than twice as many as the next largest Asian market, Indonesia (3.34 billion installs).

-

By revenue, India ranks 8th in Asia. Market revenue exceeded $400 million since April 2024. Sensor Tower specifically highlights the region’s monetization challenges.

-

It’s clear that in recent years, game downloads in India have been declining—and the rate of decline accelerated in the second year straight.

-

The trend for IAP revenue growth in India is positive. But there are a few important factors: first, the low base effect; second, the growth rate is slowing.

-

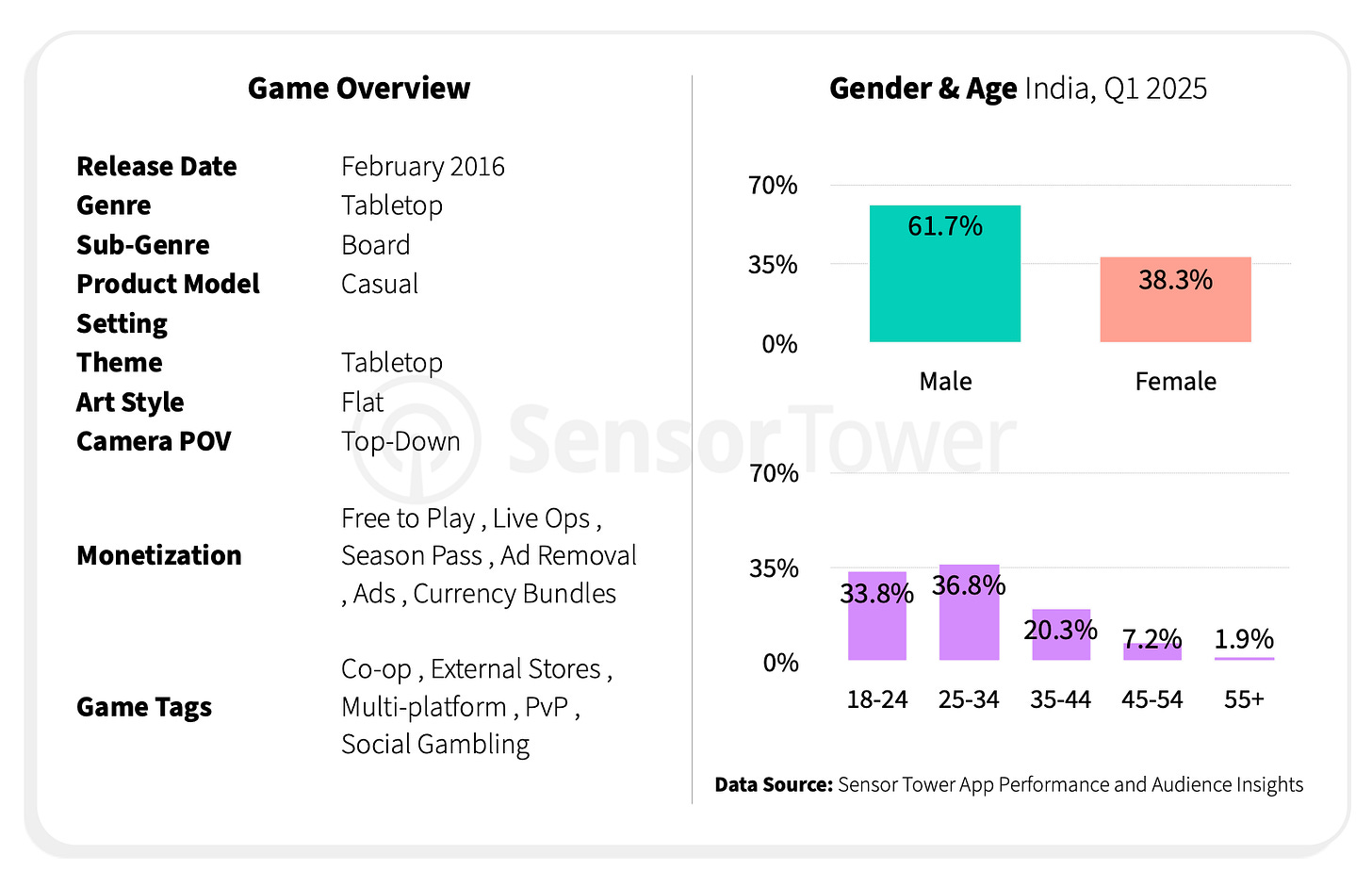

The typical mobile gamer in India is male (86% of all players), aged 18 to 34 (77% of the total). Genre distribution by age and gender is quite typical.

-

Simulators (22%), arcade games (19%), and puzzles (16%) lead by downloads in India.

-

But the revenue picture is more straightforward. 50% of all money comes from shooters.

-

Looking deeper at genres, for some reason, driving/flight simulators lead by downloads in India (despite a 2.6% YoY drop). Second place: platformers/runners (-18% YoY), third: board games (+0.8%).

-

Top revenue genres: Battle Royale (specifically Garena Free Fire and PUBG Mobile, up 5.7% YoY). Second: Match-3 (-7.4% YoY), third: Coin Looters (including Coin Master, down 5.8%). The strongest revenue growth came from location-based games (thanks to Pokemon GO, up 548.8%). Sandboxes (+59.6% YoY), realistic sports sims (+26.6% YoY), and 4X strategies (+9.4% YoY) also posted strong numbers.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

If you look at the most downloaded projects in India from April 1, 2024, to March 31, 2025, the leaders are mostly region-specific titles: Ludo King, Zupee, Dream11 (fantasy sports), Indian Bikes Driving 3D, Cricket League, WinZO Ludo, Carrom Pool.

-

Meanwhile, the download growth chart looks more like other global markets, at least half the games also appear in download charts in other countries.

-

But the revenue situation is the opposite—there’s not a single culturally specific Indian project in the top 10 by revenue, if we don’t count Battlegrounds Mobile India.

-

Garena Free Fire, Battlegrounds Mobile India, Coin Master, Candy Crush Saga, and eFootball are the top revenue generators in India from April 1 to March 31, 2025.

-

Regarding revenue growth, Pokemon GO stands out (cause unclear). Last War: Survival is gaining ground. Mobile Legends: Bang Bang has also entered the rankings. Given its social focus, the project might establish itself in the local market.

-

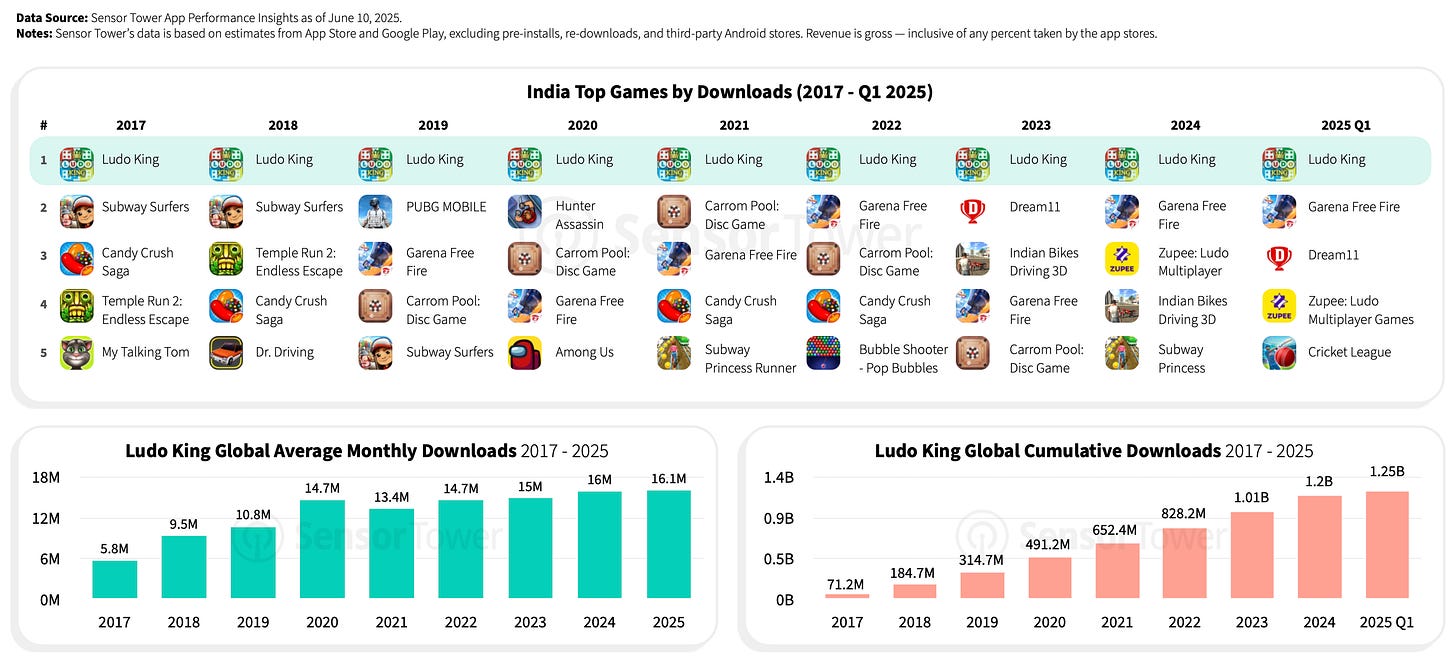

Ludo King has been the #1 game in India by downloads since 2017. The project has been downloaded over 1.25 billion times. The average monthly downloads continue to grow.

-

The project’s popularity is due to several factors. The key one is the popularity of the board game in the country and the successful adaptation of that beloved experience to mobile.

-

Additionally, the developers run smart ad campaigns. Their messaging emphasizes social interaction, spending time with family and friends—all important for Indian users. The game also features voice chat, which turns out to be important for the local market.

-

Indian game companies get most of their downloads from the local market, but most of their revenue comes from international markets. Key international download markets: Indonesia, USA, and Brazil. By revenue: USA, Saudi Arabia, and the UK.

-

Top Indian developer downloads: Ludo King (Gametion), Indian Bikes Driving 3D (Rohit Gaming Studio), and Dream11 (DREAM11 FANTASY PRIVATE LIMITED). By revenue: Ludo STAR (Gameberry Labs), Crossword Jam: Fun Word Search (Playsimple Games), and Coloring Games for Kids 2-6 (Internet Design Zone).

-

The Little Nightmares series has sold over 20 million copies. Little Nightmares 3 is coming out on October 10 this year.

-

Peak sold 2 million copies in 9 days. The first million was reached in 6 days.

-

Rematch sales exceeded 1 million copies, and the player count reached 3 million(including Xbox Game Pass subscribers).

-

Dune: Awakening has sold over 1 million copies, becoming the fastest-selling title among all Funcom releases.

-

Broken Arrow earned $14.3 million in gross revenue in the first couple of weeks after launch (according to VG Insights). China (22% of the audience), the USA (19%), and Russia (13%) are the largest markets for the game.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Hooded Horse and Sad Socket reported 400,000 copies of 9 Kings sold in a month. The game is in Early Access.

-

Over 1 million people have played FBC: Firebreak. This doesn’t reflect sales, since the game launched on PS Plus and Xbox Game Pass.

-

Resident Evil Requiem is highly anticipated. In just a couple of weeks after its announcement at Summer Game Fest, more than 1 million people added the game to their wishlists.

-

Indie horror No, I’m not a Human has over half a million wishlists on Steam.

-

Following Peak’s success, Cairn, another game with the same core idea, reported 500,000 demo downloads.

-

Uma Musume: Pretty Derby launched worldwide on June 26. By the time of the international release, the game had generated $2.6 billion in revenue from Japan alone.

-

Hero Wars: Alliance (mobile) has earned over $1.7 billion over 8 years and attracted 185 million users. The browser version has generated over $650 million.

-

AppMagic says users have spent over $1 billion in SuperPlay games. Most of this comes from Dice Dreams.

-

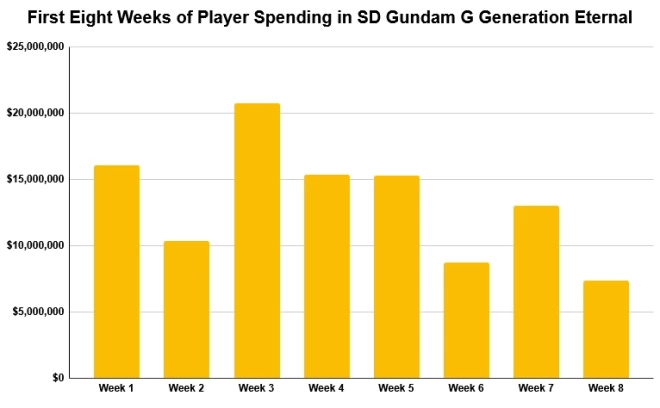

SD Gundam G Generation Eternal reached $100 million in revenue a couple of months after launch (AppMagic data). On its peak day, May 3, the game made $3.5 million.

-

Kingshot by Century Games hit $100 million in revenue, taking 117 days to reach this milestone. The main audience is in the US, accounting for 41% of total revenue.

-

Fable Town from MGVC Publishing (MY.GAMES) reached $5 million in revenue since its late 2024 release. The game has been installed 2 million times, with 440,000 MAU and 95,000 DAU.

-

Game of Thrones: Kingsroad needed 36 days to reach $1M in mobile revenue (AppMagic data). This likely falls short of Netmarble’s expectations.

-

FreePlay Studio’s games have been downloaded over 2 billion times, with 80 million MAU.

-

Fallout Shelter has been downloaded over 230 million times in total. This figure was shared for the project’s 10th anniversary.

-

Grow a Garden in Roblox set a new record: 21.3 million concurrent players, a significant industry milestone.

AppMagic provides revenue data net of store commissions and taxes. Revenue from Android stores in China is not included.

-

Honor of Kings ($143.3M), Whiteout Survival ($127M), and Last War: Survival ($126.4M) were the top earners in June 2025.

-

Honor of Kings still generates the majority of its revenue in China. Revenue in other countries is not growing significantly. The game has already made over $13M in the US, but compared to China, these numbers are tiny.

-

Pokemon GO jumped 10 spots in the chart to 8th place, earning $62.6M—almost twice as much as last month.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Kingshot continues steady growth. The game entered the top 15 for the first time (14th place), earning $37.2M in June. Its growth curve is just impressive.

-

The top three remain unchanged: Block Blast! (just over 29M installs), Roblox(26.7M), and Subway Surfers (16.7M).

-

Newcomers to the top 15 are Music Piano 7: Rush Song Games (14.6M downloads) and Moto Race Go (11.9M installs). Otherwise, no major changes.

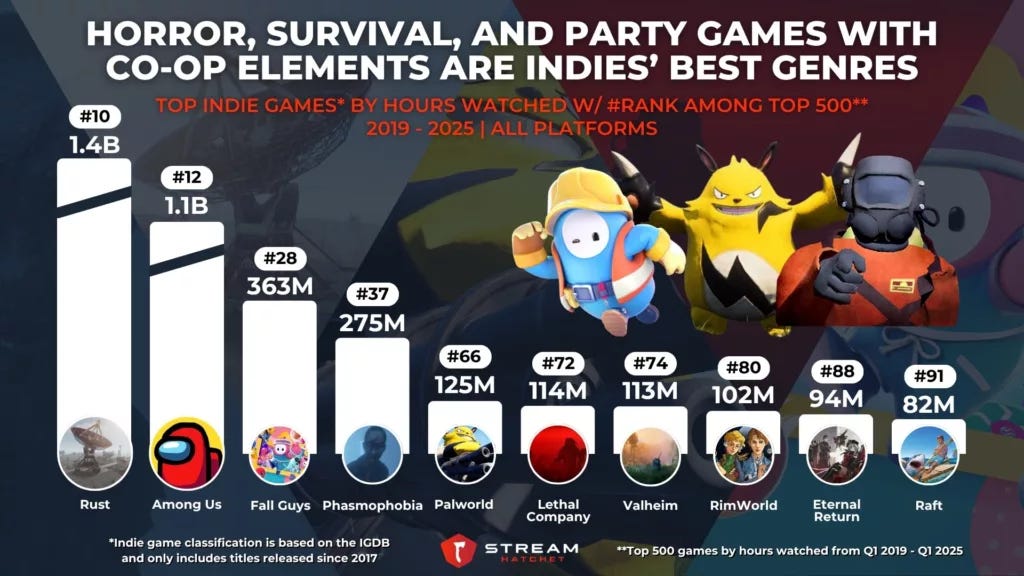

Stream Hatchet excluded so-called Triple-I projects from the sample, where large teams (often with over 50 people) work on relatively small projects. For example, Black Myth: Wukong is excluded from the sample, even though some systems classify it as an indie game. Indie projects that later became major franchises (Minecraft, Five Nights at Freddy’s) are also excluded.

-

Indie games accounted for about 10.3% of total user watch time in Q1’25. This is significantly higher than 6 years ago.

-

However, it can’t be said that indie game watch hours have been growing recently. The peak was in Q2’23—14.6% of all watch time was for indie games. Since then, there’s been a decline.

-

If you look at the top 500 games by watch hours, a third of them are indie projects.

-

At the same time, only 9% of indie games on the market have more than 5 million hours on streaming platforms in their first 30 days. Among AAA games, it’s 33%. This is largely due to indie developers lacking serious marketing budgets.

-

Less than 1% of indie games managed to reach 30 million watch hours (or more) on streaming platforms in the first 30 days. Fall Guys (253 million), Phasmophobia (128 million), and Palworld (121 million) achieved this. Even so, they haven’t become permanent chart-toppers, they get pushed out by either AAA projects or new indie hits.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

The most popular indie projects on streaming platforms are represented by three genres: horror, survival, and cooperative party games.

-

Since 2019, two projects have more than 1 billion hours on streaming platforms—Rust and Among Us.

-

It’s worth noting that all games except RimWorld are multiplayer. Even RimWorld has multiplayer mods.

-

Moreover, most of the projects on the list offer cooperative multiplayer specifically.

-

The main streamers focusing on the indie market are caseoh_, eliasn97, Miko Ch. Indie developers should include them in their mailing lists.

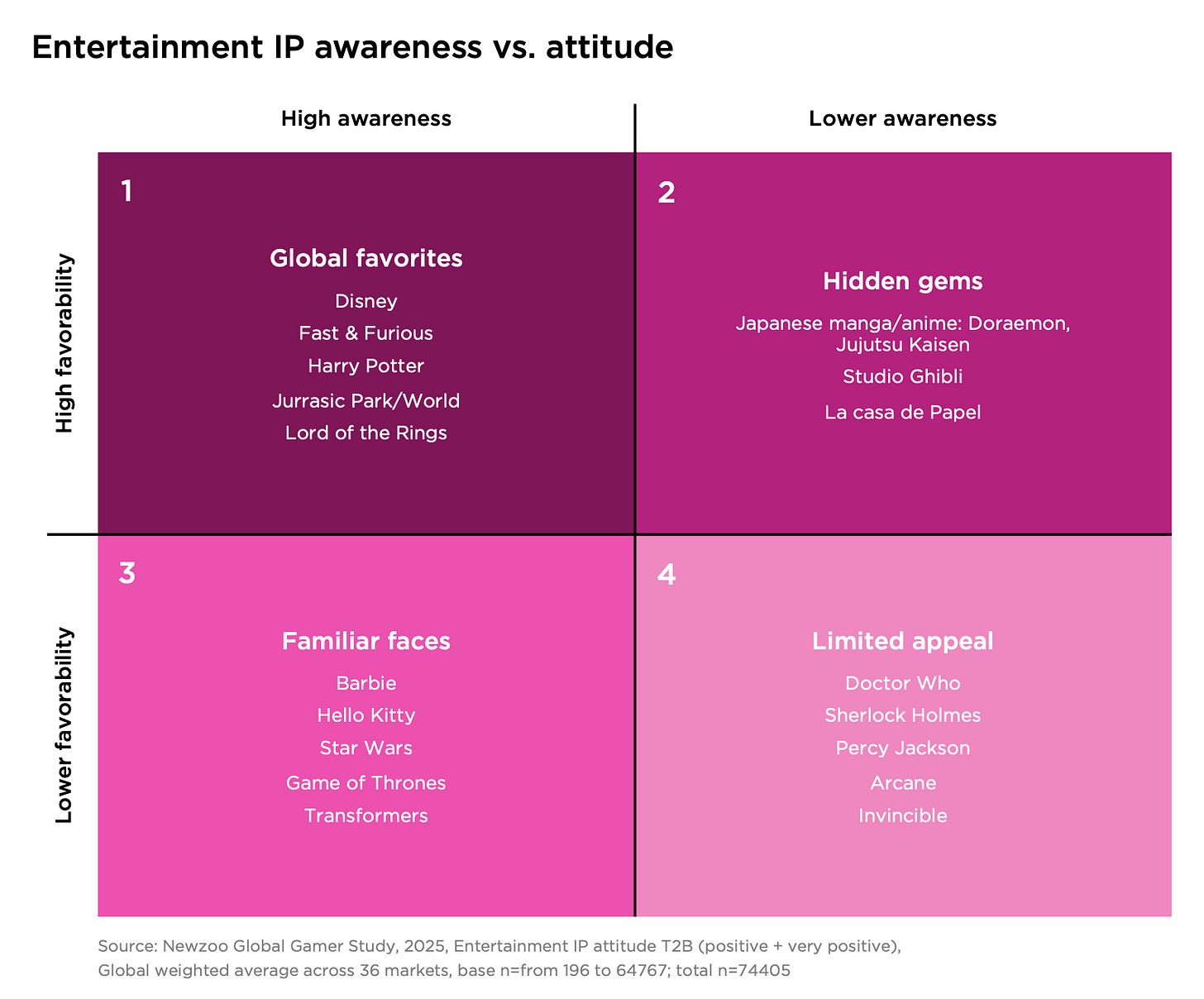

The company analyzed 36 markets and 42 popular IPs while preparing the report.

-

The strength of IP has a significant impact in China, Southeast Asian countries, India, and Brazil. More than 70% of respondents in these countries noted that they would be more likely to play a game based on a well-known IP.

-

In contrast, in Western European countries (Belgium, the Netherlands), Northern Europe (Finland, Sweden), and Japan, the influence of IP—according to the audience survey—is almost half as strong.

❗️That’s interesting, because Japanese charts are full of IP-based games.

-

“Universality” and recognizability of IP are important factors. For example, the leader in this matter is Disney. In second place, with a slight lag, is Dragon Ball.

❗️I can hardly imagine that 30% of Americans do not know DC Universe characters. Let’s leave that on Newzoo’s conscience.

-

There is a noticeable correlation between the region where content is produced and its popularity. American IPs are more popular in North America and Europe, while Japanese IPs are more popular in Japan and Southeast Asian countries.

-

Newzoo, for example, notes the popularity of La Casa De Papel in Latin America. And despite the fact that the series was produced in Spain, it became a cultural phenomenon in Spanish- and Portuguese-speaking LATAM countries, largely thanks to familiar cultural references and language.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Shrek, Harry Potter, Disney cartoons, and Doraemon lead the list of user favorites worldwide.

-

Meanwhile, Hello Kitty, Yu-Gi-Oh!, Naruto, and Barbie are on the “least favorite” list. It’s important to note that users do not have a negative attitude toward these franchises—just fewer people reported a positive attitude toward them.

-

Newzoo has prepared a map of IPs that can be used when searching for project collaborations. In quadrant 1 are projects loved by the audience with a large reach. In quadrant 2, audience favorites with a smaller reach. In quadrant 3 – IPs with a large reach but a low positive audience response. In quadrant 4, IPs with low reach and low positive audience response.

-

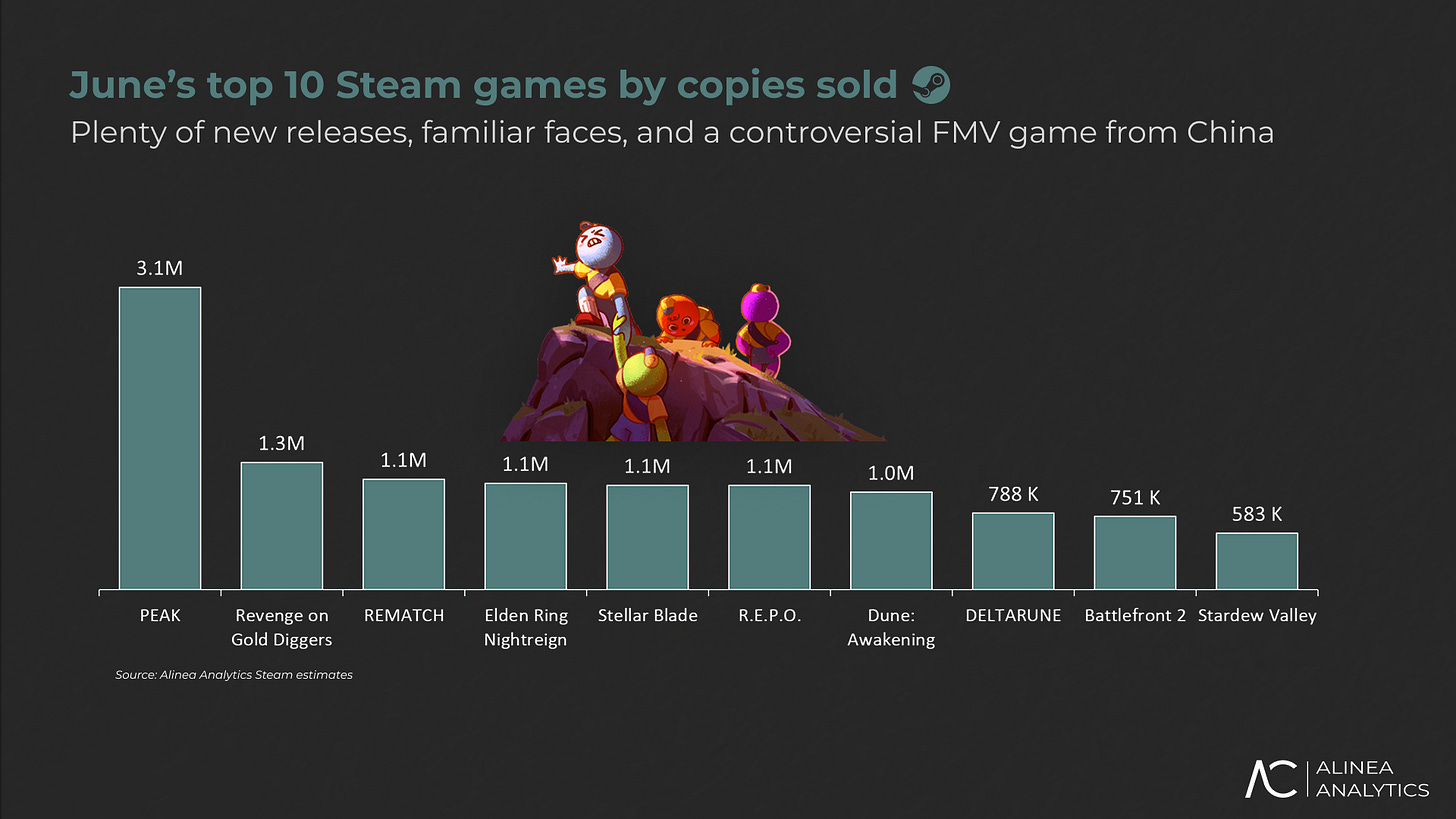

PEAK, released on June 16, sold an estimated 3.1 million copies and earned $17 million, according to Alinea Analytics.

-

61% of PEAK buyers also played R.E.P.O. 40% are Content Warning owners. 30% played Chained Together or Lethal Company. In other words, there’s a significant overlap with similar genres in style and concept.

-

Revenge on Gold Diggers (情感反诈模拟器) had major success in June. This is an FMV dating simulator available only in Chinese. It sold 1.3 million copies in June. 73% of sales were in China, with the US accounting for 10%.

-

Third in sales is Rematch, which sold 1.1 million copies on Steam. Revenue nearly reached $30 million.

-

Elden Ring Nightreign added another 1.1 million copies—total Steam sales reached 2.5 million (plus 1.3 million on PlayStation).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

Stellar Blade launched successfully—1.1 million copies sold. 54% of buyers are from China.

-

R.E.P.O. continues to sell well. June sales were 1.1 million copies, with total sales reaching 15.4 million. Alinea Analytics estimates the game has already earned $121 million.

-

Dune: Awakening also had a strong launch, selling over a million copies.

-

Mecha Break, Wuchang: Fallen Feathers, and Killing Floor III are games Alinea Analytics recommends watching in July 2025.

-

Returning to the charts, in 8th place is Deltarune (788,000 copies), a new game from the creators of Undertale, set “not in the Undertale world.” 40% of the audience is from the US, and 63% are Undertale owners. Despite high sales, the game still has over 2 million unclaimed wishlists.

-

Star Wars: Battlefront II made the top 10 with 751,000 copies. Sales were boosted by the annual Star Wars franchise celebration and a massive 90% discount.

-

And in tenth place is Stardew Valley with 583,000 copies. The game was released in 2016.