TipRanks

8 min read

In This Article:

Let’s talk about gaming – casino gaming. There’s an attraction to it, the thrill of trying to beat the house and walk away with a big win, that consistently draws customers in. For investors, though, the appeal lies in a different reality: understanding that the odds reliably favor the house. This dynamic, where the customer’s dream collides with the casino’s business model, makes the sector uniquely compelling from both a social and financial standpoint.

-

Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

-

Make smarter investment decisions with TipRanks’ Smart Investor Picks, delivered to your inbox every week.

Yet investing in this industry is hardly straightforward. The sector faces meaningful risks, with potential tariffs in the second half of 2025 threatening to dent discretionary consumer spending, while economic uncertainty could amplify the pressure. These headwinds are even more intense for casinos with strong ties to China, limiting their prospects in the near term. Meanwhile, US-based digital casinos may avoid some global macro challenges, but their growth is still complicated by a patchwork of state regulations and varying tax regimes.

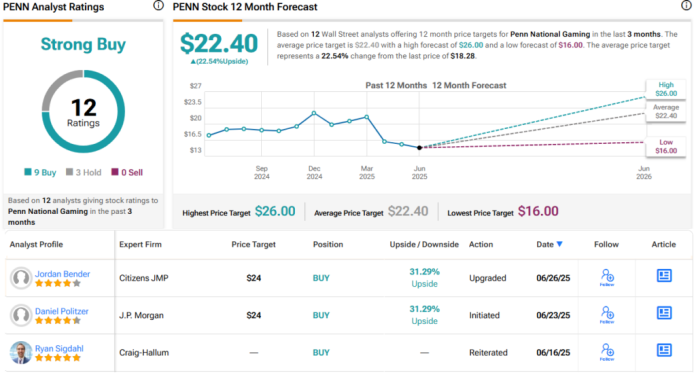

In light of these complex forces, JPMorgan analyst Daniel Politzer has taken a close look at how investors might profit from gaming stocks despite the hurdles. He frames the conversation around a crucial question: how does one actually make money in this sector?

“In the short term, gaming stocks tend to be momentum-driven and dictated by transparent factors like news cycle/catalysts as well as intangibles such as positioning, sentiment, and narratives,” Politzer explained. “Similarly, earnings can be volatile, and thus for near-term-oriented investors, it’s imperative to have a strong grasp of expectations/estimate revision risk as well as the aforementioned intangibles. In the medium/long term, the key drivers of gaming (and lodging) stocks are CAGE: Capital allocation, Asset quality, Growth prospects, and Earnings visibility. Management quality/credibility is also important, albeit intertwined with CAGE. Gaming is a value-oriented sector, and valuation is important, but long-term secular trends or capital structure changes can have an outsized impact on long-term share performance.”

Building on that framework, Politzer has highlighted two gaming names that stand out in this environment. Let’s explore why he sees these particular stocks as worthy of a closer look in the second half of this year. And by delving into the TipRanks database, we can also find out if the analyst consensus agrees with Politzer’s choices.